Beyond Buying: Thoughts on the Art of Selling Stocks

A framework to think about when to sell at the right time

I've heard many legendary investors say that it is harder for them to know when to sell than it is to know when to buy.

Others, like Philip Fisher, author of the renowned investment book "Common Stocks and Uncommon Profits", have expressed: "If you have done your research properly when purchasing a stock, the time to sell is, in most cases, never".

It is undeniable that knowing when to sell is essential in determining your results as an investor. Therefore, I believe that it is vital to reflect on how to perfect or, at least, systematize this aspect of the investment process. In this article, I share a framework to think about when to sell at the right time

Valid reasons for selling can be classified into two main categories: those that relate directly to the company and those that are external to the business itself.

Reasons to Sell That Are Related to the Company

So, below there are four valid reasons to sell a position that are related to the company itself.

1) The Facts Are Not What I Thought

It is entirely possible that, even with meticulous research and taking all necessary precautions, we will face surprises. The world is complex, and some facts that we believed to be true may turn out not to be true.

We might discover that a management team is not what it seemed. After all, we are dealing with human beings, dynamic people who change and evolve over time. This may be one of the most common and likely reasons to sell a stock: management not being of the quality we originally perceived.

Another reason could be that the moat or competitive advantage we thought existed actually does not, and the competition is eroding our company's position.

External factors could also arise that impact the company's results more than we originally considered. Take, for example, the case of Nagarro, one of the most talked-about companies Spanish fintwit. Many investors are now recognizing that it is a more cyclical company than initially thought and that it responds strongly to clients' capex cycles in their digital transformation processes.

Finally, one of the most specific and determining reasons when selling a position is the appearance of accounting irregularities that could undermine our confidence in the management team.

2) The Facts Are Evolving For The Worse

This is when I see that the quality of the business can begin to deteriorate naturally due to the evolution of different forces that affect the company.

For example, the moat may begin to erode due to technological factors, such as the emergence of artificial intelligence, leading many companies to rethink their business models. Look at the case of Chegg Inc, for example.

Another case where events evolve negatively could be a poor allocation of capital by the management team. This happens when they use the funds generated by the company to destroy value instead of creating it.

If management begins to make decisions that do not make sense, such as acquiring companies unrelated to the main business and in which the company does not have clear expertise, we are faced with a possible reason for sale. Lynch called this practice "de-worsifying" because, although they diversify, they do so in a way that destroys shareholder value.

In addition to acquiring unrelated businesses, another worrying sign is if the management team attempts a "transformative acquisition," taking on exponential risks.

Other occurrences that indicate an unfavorable evolution of events may be a worsening of the brand, reflected in negative reviews on pages such as Trustpilot; involvement in a lawsuit that could affect future profits; a deterioration in company culture, evidenced by negative reviews on sites like Glassdoor; an exodus of key management team members; or a problematic leadership transition.

3) Investment Thesis is Realized

This reason for selling a position is most common in investment theses that focus on a specific catalyst.

Once the catalyst occurs (or not), it becomes necessary to consider selling the shares. Some examples of these investment theses with catalysts are sum-of-the-parts theses or investments in a spin-off.

Another situation where the decision to sell may arise is if the company no longer has room to grow in its target market and I see no signs that the management team is looking to innovate in new markets. It is likely that the company will reach a stage of stability.

In these circumstances, it is common to see organic growth being less than 5% or profit growth falling below 10%.

4) The Company is Acquired or is Going to be Acquired

This situation manifests itself when the company in which I have invested receives a purchase offer from another entity at a specific price.

It is common that, upon receiving a purchase offer, a premium over the current market price is offered to encourage shareholders to sell their shares.

Thus, the share price usually jumps to a value close to that proposed for the transaction. However, due to the inherent risk that the transaction may not go through, the share price rarely matches the offer price exactly.

When faced with events of this nature in companies where I have investments, I usually get rid of the position before the transaction is carried out, given that the remaining profit potential is limited.

Reasons to Sell Not Related to the Company

1) Liquidity Calls

Many times, if I am 100% invested and discover a new investment idea that surpasses some of those that are already part of my portfolio, I sell and start a position in that new opportunity.

This is especially true if the new idea offers a greater margin of safety or prospects for superior returns in the future.

2) Need for Cash for Personal Expenses

As individual investors, it is natural that at certain times we must sell some positions to meet our personal expenses.

This motivation is not directly related to the performance or health of the company in question but responds to external reasons, which is why I include it in this list.

3) Tax Reasons

If our confidence in any of the positions has decreased and, simultaneously, we are facing losses, the opportunity may arise to sell and take advantage of what is called "tax harvesting" in the United States.

This process allows losses to be used to reduce capital gains tax. The viability of this strategy varies depending on the tax regime of each country.

5) Loss of Interest in Following Up on the Company

Personal reasons also count. If I lose interest in closely monitoring a company, it's probably time to sell. Lack of interest increases the probability of making mistakes in monitoring and managing that investment.

Bad Reasons to Sell a Stock

Are there any bad reasons to sell a stock? Well, probably the ones below are good candidates for that.

1) The Stock Is Overvalued or Expensive

When arguing that a stock is overvalued, it's not enough to look at multiples alone. It is essential to also consider future growth and the probability of achieving that growth. Yes, do real valuation.

While it is often difficult to determine whether a company is truly overvalued, there are situations that can be obvious.

I've heard well-known investors like Mohnish Pabrai point out that if a stock looks ridiculously expensive, such as with a multiple greater than 30x EV/EBITDA, consider selling it.

2) The Stock Has Already Rallied Enough

Another inappropriate argument for selling a stock is to consider that it has already risen "enough."

As I mentioned earlier, the crucial thing is to evaluate the company's future ability to generate profits and, based on that, evaluate its current price.

This reason for selling usually arises from the fear of losing already accumulated profits, leading the investor to close the position prematurely.

3) Sell a Stock Waiting for a Correction

Choosing to sell a stock in the hope that its price will decrease later in order to buy it cheaper is not a valid reason according to the value investing philosophy.

These arguments tend to be based more on trading strategies that rely on technical indicators or other methodologies.

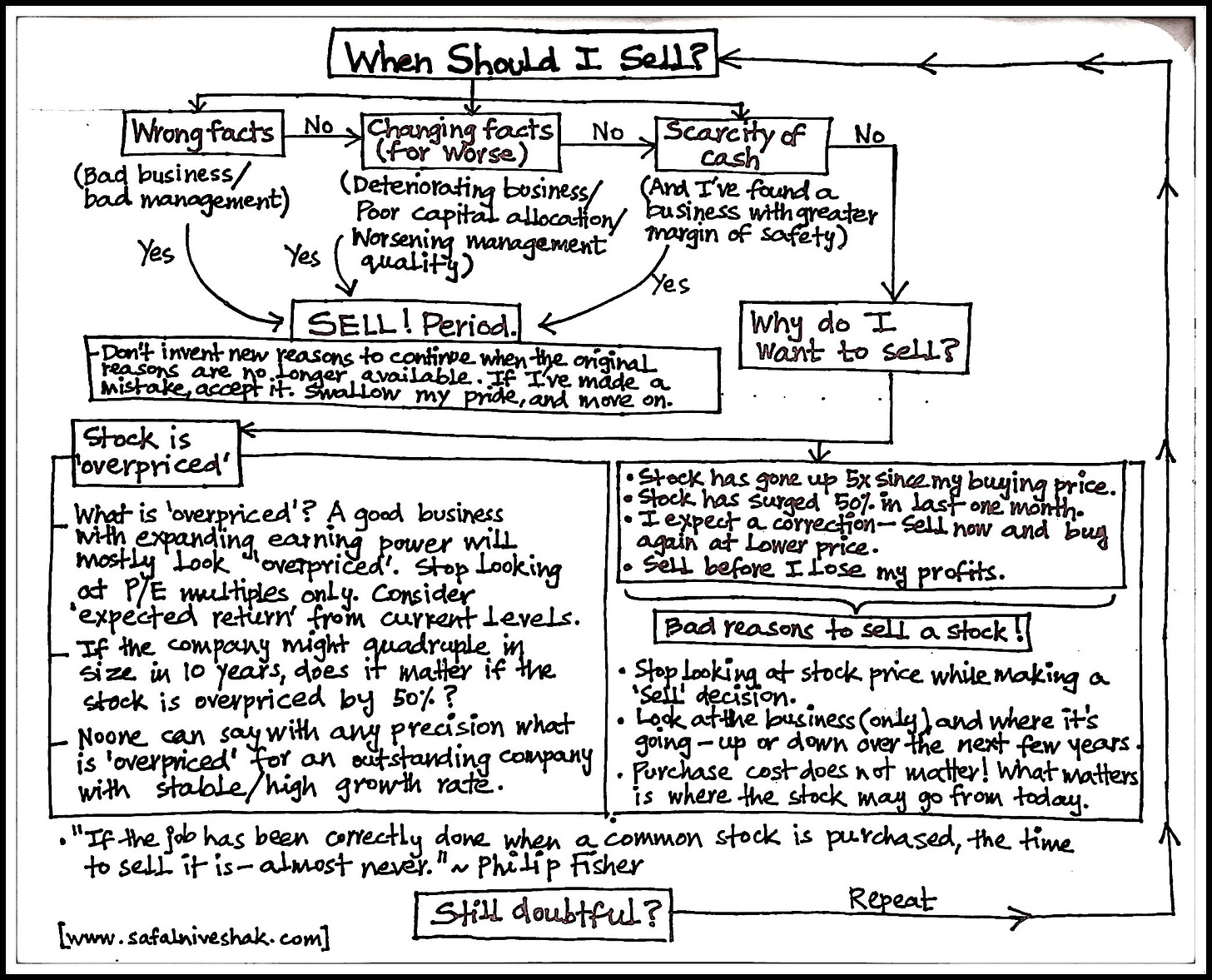

A few years ago, I found this little diagram on Twitter. I hope it’s also useful in determining when to sell a stock (attribution is in the image).

Conclusion

As we have discovered, there are good reasons to sell (intrinsic or extrinsic to the company) and bad reasons to sell. As fundamental investors, we should not base selling decisions on the share price but rather on a thorough analysis of the company's prospects.

I hope this guide helps you refine your process for exiting positions, which will eventually lead to better results in your career as an investor.

As always, I share the investment checklist below.

Investment Checklist

Intrinsic Reasons

The facts are not what we thought: in the unpredictable world of investing, even after thorough research, surprises are possible. These surprises may arise due to changes in the management team, the erosion of competitive advantage, or external factors that impact the company.

The facts are evolving for the worse: businesses, like the world, are constantly changing. A company that previously enjoyed a robust competitive advantage may see it diminish due to technological advances or changes in the industry. Additionally, poor decisions by the management team, such as poorly planned acquisitions or misallocation of resources, can be signs that the quality of the business is declining. Public perception and company culture are also factors to monitor, as they can influence the long-term health of the company.

The investment thesis was carried out: there are times when you invest in a company based on a specific catalyst or a specific investment thesis. Once this catalyst materializes, there may be no more upside potential left and therefore it could be the right time to sell. This scenario also occurs when a company reaches its maximum point of growth and maturity, and no longer has the growth prospects it previously had.

The company is acquired or is going to be acquired by another company: When another entity expresses interest in acquiring a company in which we have invested, the share price usually approaches the value offered in the transaction. However, given the uncertainty of whether the purchase will be completed or not, the price does not always coincide with that of the offer. In such circumstances, many investors choose to sell before the transaction to ensure a return and limit risk.

Extrinsic Reasons

Liquidity Shortage: if I am fully invested and discover a new investment opportunity that looks better than the current ones in my portfolio, I may consider selling some stocks to take advantage of this new opportunity. I have to be careful about the "house money effect", which could make me feel more comfortable taking risks when I have profits.

Dominant position in the portfolio: if a company becomes too large a portion of my portfolio, such as more than 40%, it may be prudent for me to reduce that position to diversify my risk. Personally, I prefer not to have more than 15% invested in a single company, even if it is high quality and has a good future.

Need for cash for personal expenses: as an individual investor, sometimes can need to sell some of my investments to cover personal expenses. This decision to sell is not related to how the company is performing, but rather to my own financial needs.

Tax reasons: if my confidence in an investment declines and I am facing losses, I may consider selling to take advantage of tax harvesting in the US, which allows me to use those losses to reduce my capital gains taxes. However, the effectiveness of this strategy may vary depending on my country's tax laws.

Loss of interest in following up with the company: if I lose interest in following a company closely, it could be a sign that it's time to sell. Not being fully involved or informed can increase the risk of making mistakes in my investment.

Bad Reasons to Sell a Stock

The stock is overvalued or expensive: considering a stock's overvaluation means looking beyond multiples and taking into account future growth. In general, selling because the stock is overvalued is a bad idea.

The stock is already up enough: just because a stock has gone up a lot is not appropriate; it is better to evaluate the potential for future earnings.

Sell a stock waiting for a correction: sell hoping to buy back cheaper does not align with value investing philosophy and has more to do with trading based on technical indicators.

Sources

Graham, B. (2006). The Intelligent Investor: The Definitive Book on Value Investing. HarperBusiness.

Fisher, P. A. (2003). Common Stocks and Uncommon Profits and Other Writings. Wiley.

Shearn, M. (2011). The Investment Checklist: The Art of In-Depth Research. Wiley.

Gawande, A. (2011). The Checklist Manifesto: How to Get Things Right. Picador.

You may be interested in this post, which also explores the issue of 'when to sell', albeit from a different perspective: https://rockandturner.substack.com/p/investing-subconscious-myopia