[Deep Dive] A De-Risked Nuclear Renaissance Play Positioned for Strategic Takeover

Risk-reward analysis supports an attractive, asymmetric return profile, creating multiple paths to realize shareholder value

Dear Reader: If you’ve been following this newsletter, you'll know that I haven’t sent out any investment write-ups so far. However, going forward, I think it would be interesting to share more concrete ideas. That’s why today I’m sharing a glimpse of the work I do at Forterra Investment Management. Forterra is an independent boutique investment manager specializing in wealth-creating smaller companies. If you want to find out more about Forterra, please visit the website at https://www.forterrainvest.com.

Given the ongoing market volatility and evolving tariff landscape, please note that the figures discussed here may need adjustment as new data emerges.

With that introduction, let's explore Velan Inc. (VLN), a Canadian small-cap company. I believe Velan presents an interesting situation, benefiting from some favorable tailwinds and including strong optionality.

As always, this information should not be considered investment advice. Please refer to the disclaimer at the end of this document. Additionally, I've prepared both a PDF and a Google Doc for your convenience, which you can download using the links below:

https://docs.google.com/document/d/1B7QqaOHRmA3GrfbCXVlKNoWkC2ZG2_HehUrzXDh8mBA/edit?usp=sharing

Let’s dive in!

Executive Summary

Investment Thesis Overview

Velan Inc. (TSX: VLN), a global leader in industrial valve manufacturing, is positioned as a compelling turnaround story with significant potential for acquisition. Standing at a critical inflection point, Velan has recently taken major steps to eliminate its asbestos liabilities and divest key French subsidiaries. These moves significantly de-risk the business and generate substantial cash proceeds, positioning Velan for renewed focus on its valve manufacturing operations—particularly in the high-growth nuclear, defense, and energy transition markets.

Core Business & Competitive Edge

Velan is a global designer and manufacturer of industrial valves, with 12 manufacturing plants serving nuclear, oil & gas, LNG/cryogenics, pulp & paper, mining, shipbuilding (including defense), and chemical industries. Its deep expertise in critical, high-spec valves for nuclear and naval applications sets it apart. Stringent quality certifications (e.g., ASME) and a 75-year reputation for reliability create barriers to entry, support premium pricing on specialized valves, and drive strong customer loyalty.

Turnaround Actions & Financial Upside

Asbestos Liability Divestiture: Velan eliminated future exposure by transferring US asbestos liabilities to a third party, removing a longstanding overhang that deterred potential acquirers and complicated the balance sheet.

Sale of French Subsidiaries: The sale of Velan’s French operations (Segault/Velan France) for ~$198M eases state-imposed barriers to M&A and injects fresh capital. It also lets Velan refocus resources on higher-margin valves outside France.

Improved Margins & Growth: Recent quarters show rising gross margins (approaching high 30% range in Q3 FY2025) and a rebound in adjusted EBITDA. The backlog now stands at $298.7M, with 83% deliverable in 12 months, underscoring near-term revenue visibility.

Key Markets & Growth Drivers

Nuclear Renaissance: Velan holds a dominant position in nuclear valve supply, with valves in over 300 reactors worldwide. Partnerships with major reactor builders (e.g., GEH for SMRs, Westinghouse, Bruce Power) signal a robust pipeline in both new-build and plant life-extension programs.

Defense Sector: A sole source for valves on US nuclear submarines and aircraft carriers; further growth expected amid global defense spending upswing.

LNG & Cryogenics: Specialized cryogenic valves serve the growing liquefied natural gas and hydrogen markets, leveraging Velan’s R&D in ultra-cold applications.

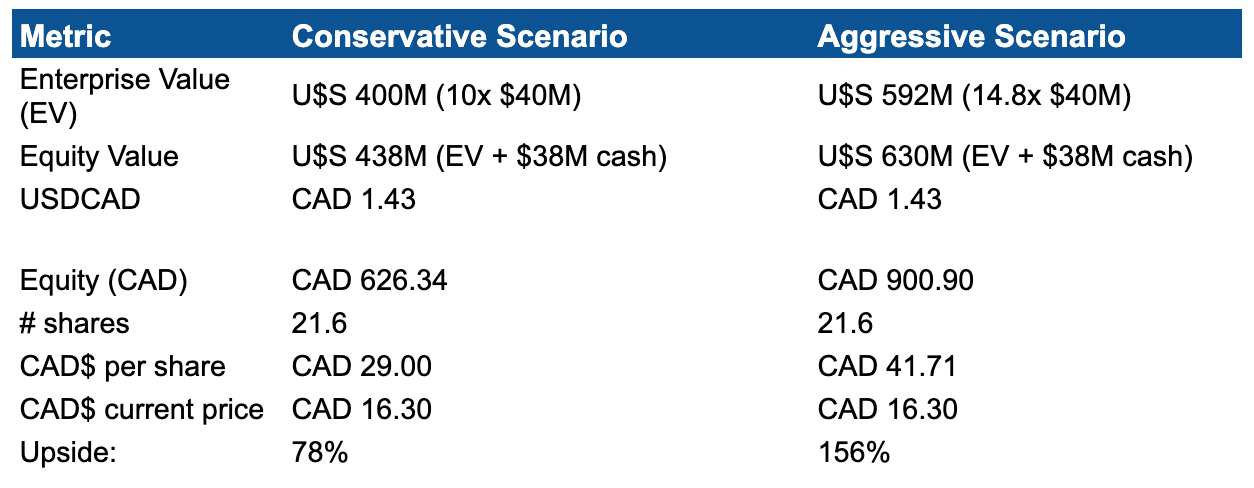

Valuation & Possible Takeover

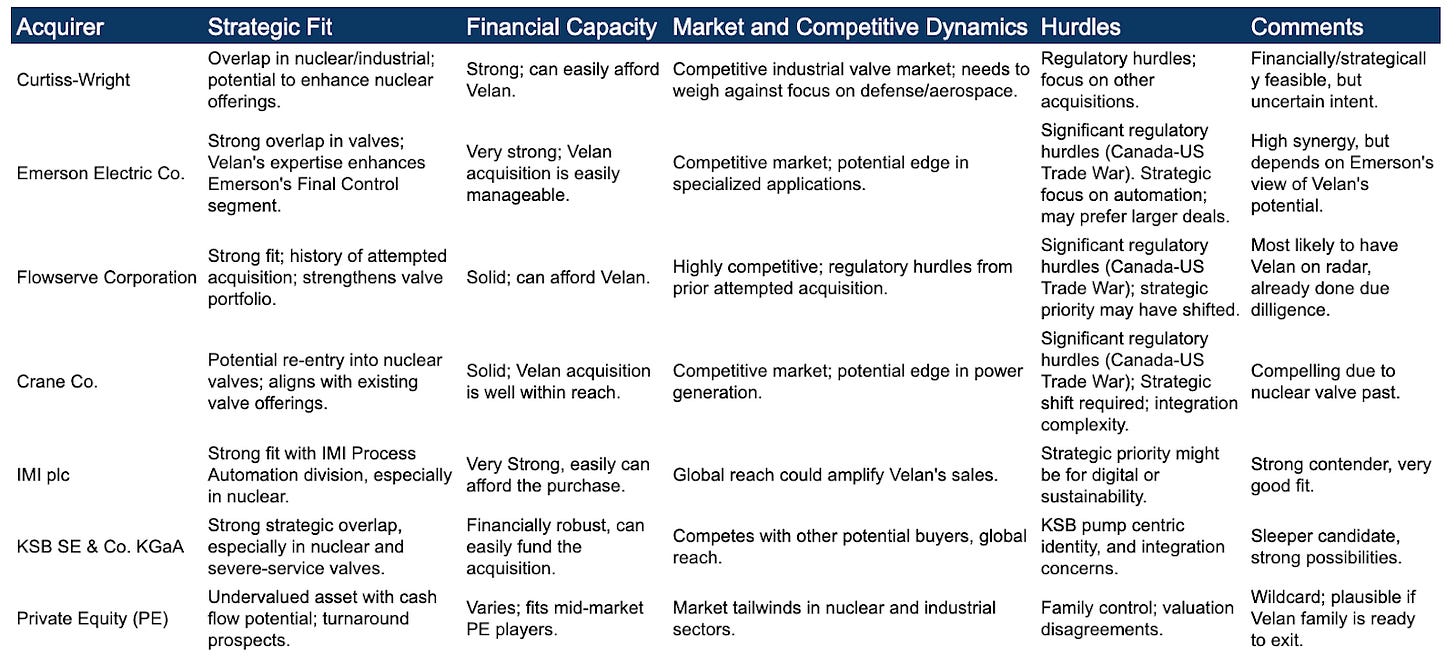

After removing asbestos liabilities and shedding its French operations, Velan appears far more attractive to large strategic acquirers (e.g., Flowserve, Emerson, etc.) that prize high-value, engineered flow-control businesses. Management is actively improving operational efficiency and a backlog-driven revenue ramp bolster the case for rerating or potential M&A.

Risks

Cyclical End Markets: Oil & gas demand, nuclear project cycles, and commodity prices can introduce revenue volatility.

Customer Concentration: Top 10 customers account for over 50% of receivables.

Execution: Must successfully convert backlog into profitable sales while integrating operational improvements.

Deal Closure: The two major divestitures (asbestos liability transfer and the French subsidiaries’ sale) must still navigate final closing conditions; any failure would reintroduce liabilities and erode the anticipated cash injection.

Supply Chain Disruption: Global logistics bottlenecks, raw material price swings, or supplier shutdowns can delay production and hamper profit margins.

Risk of Global Tariffs: Tariffs and trade barriers could increase costs or restrict access to international markets, affecting international operations.

Risk of Escalating Canada-US Trade War: An escalation in trade tensions between Canada and the US could affect the likelihood of a takeover, complicating cross-border transactions and strategic acquisitions.

Conclusion

Overall, Velan has repositioned itself as a de-risked valve specialist with a stable balance sheet, improving margins, and a deep backlog in specialized, high-growth segments. If management executes on recent operational enhancements—and given the now-clear path for a strategic takeover—Velan offers compelling upside for investors seeking exposure to global energy and defense infrastructure themes.

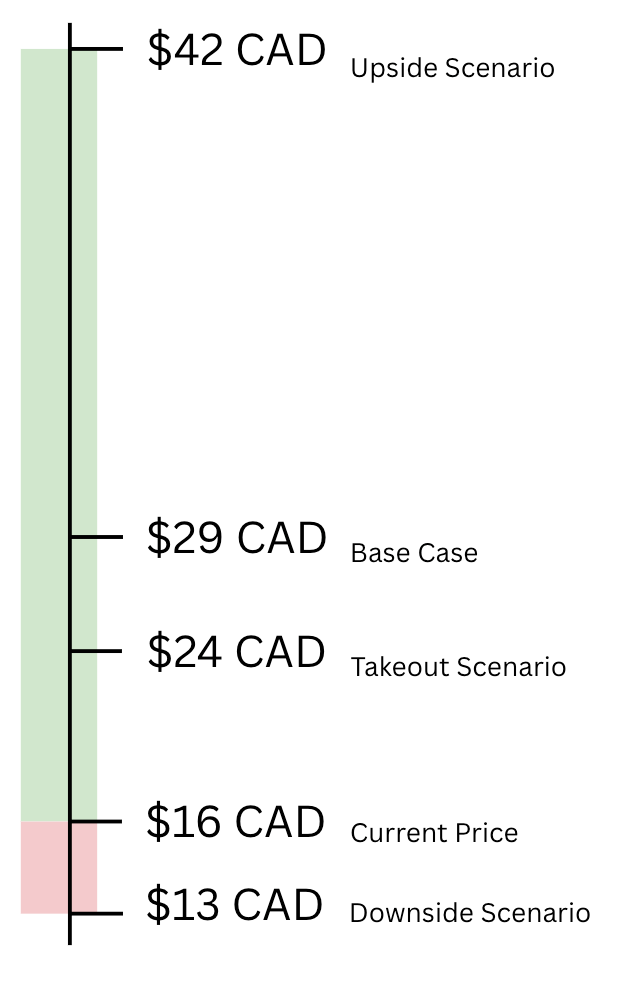

At current trading levels (roughly in the mid-teens Canadian dollars per share), the stock is trading near the prior takeover price, leaving room for upside if the business recovery continues. Our analysis finds that Velan’s intrinsic value likely exceeds the current price, supported by peer valuations and DCF modelling.

The Business: A Niche Carved in Steel

Basics

What do they do? Velan designs, manufactures, and markets industrial valves. Their valves are used in a variety of critical applications across many sectors, including power generation, nuclear, oil and gas, chemicals, LNG and cryogenics, pulp and paper, geothermal processes, shipbuilding, defense, and carbon-neutral technologies. The company emphasizes quality, safety, ease of operation, and long service life in its products. Velan also focuses on custom-designed complex solutions for demanding applications. The company has R&D centers in Montreal (Canada), Lucca (Italy) and Coimbatore (India).

How they profit Velan generates revenue through the sale of its industrial valves to customers worldwide. The company's revenue is impacted by factors including sales volume, product mix, and foreign exchange rates. Velan's business strategy focuses on customer-driven operational excellence and margin improvements, and accelerated growth through increased focus on key target markets where the Company has distinct competitive advantages, such as nuclear. The company also provides services and maintenance. It is important to mention that in this type of industry, safety and quality are the top priorities for the customer, even more than cost.

Why are they important Velan's valves are critical components in various industries, ensuring the safe and efficient operation of industrial processes. They provide solutions in sectors such as power generation, nuclear, oil and gas, and chemicals. The company's reputation for quality and reliability is paramount, particularly in demanding applications where failure can have significant consequences. Velan has established itself as a world leader in steel industrial valves, and the company's valves are of utmost importance for maintaining the integrity of critical infrastructure across multiple sectors.

It is important to mention that Velan was one of the suppliers of the first nuclear reactor in the US. They have been testing and refining their nuclear products for 60 years.

How has the business changed over time

Early Years: Velan was founded in Montreal in 1950 by A.K. Velan, initially focusing on steam traps and then expanding into valves. The company grew alongside the nuclear power industry in the 1960s and 1970s, developing products to address the industry's needs.

Growth and Diversification: Velan continued to expand its portfolio of valves for the power, oil & gas, and process industries. The company has established a global presence, with manufacturing facilities in several countries.

Leadership Changes: Velan has recently seen a transition in leadership, with the appointment of James A. Mannebach as CEO, who brings extensive experience in organizational transformation leading Emerson’s Process Flow Business (Velan main competitor) and also the Industrial Technology Division at Roper.

Velan Product & Services

Velan’s products are essential for its customers, addressing critical needs, and while facing potential commoditization in some of their segments, they are positioned in sectors that may see substantial growth.

What valves actually are and why are they important? In simple terms, valves are sophisticated on/off switches that control the flow of gases and liquids in industrial plants. They are important because many plants are designed to transport dangerous materials and the valves have to support high pressure conditions and extreme temperatures.

Velan sells a diversified portfolio of these industrial valves; including gate, globe, check, ball, triple-offset, butterfly, and control valves. This diversity allows Velan to serve a broad range of industries including:

Power generation (including nuclear, geothermal processes, etc.)

Oil and gas

Petrochemicals

LNG and cryogenics

Pulp and paper

Shipbuilding

Mining

Defense

HVACs

Carbon-neutral technologies

Velan's products function as "pain killers," these are products that are essential for its customers. The company’s valves are used in critical applications where safety and reliability are paramount. The failure of these valves can lead to significant consequences, including operational disruptions, environmental damage, and safety hazards. Industries such as nuclear, oil and gas, and chemical processing require high-quality valves to ensure the safe and efficient operation of their facilities. Therefore, Velan's products are not merely “nice-to-haves” but “must-haves” for its clients.

Velan’s Value Proposition Velan’s products alleviate several key pain points for its customers:

Ensuring Operational Safety: Velan's valves are designed to perform reliably in critical applications, reducing the risk of accidents and ensuring the safety of industrial processes. For example, in nuclear power plants, the reliability of valves is the most important factor to consider as it prevents potential disasters.

Maintaining Process Efficiency: High-quality valves help ensure that industrial processes operate smoothly without interruptions. Valve failure can cause downtime, leading to production losses. Velan's focus on quality and long service life ensures minimal disruptions.

Meeting Stringent Requirements: Industries like nuclear power and petrochemicals have demanding safety and quality requirements. Velan’s valves meet stringent quality and safety certifications like ISO 9001 and ASME. The company’s products are recognized for their ability to meet the needs of critical sectors, leading to high customer loyalty.

Reducing Maintenance Time: Velan provides products that allow for easy visual examination of joints during checks on-site which can reduce maintenance time, which is a key safety point to consider during the product design phase

Addressing Environmental Concerns: The company is also aligned with the increasing focus on energy-efficient solutions, as many customers are seeking to reduce their carbon emissions. Velan has dedicated resources to develop environmentally driven solutions.

Risk of Commoditization While Velan's valves are made from steel, a commodity material, the company is not solely selling a commodity product. Even though the company competes with manufacturers in low-wage countries, Velan differentiates itself through quality, safety, and reliability, focusing on providing valves for demanding applications. The company's investment in R&D also allows them to innovate and offer advanced solutions.

Their global presence, diversified customer base, and focus on critical applications also provide an edge in the market. The company has a preeminent brand globally that is a key part of its value proposition. Additionally, Velan focuses on providing custom-designed complex solutions for demanding applications, which helps reduce the risk of commoditization by providing specialty products rather than generic ones.

Product Cyclicality Velan's sales are generally cyclical. The demand for its products varies based on the level of economic activity in specific industries and markets. The company acknowledges that downturns in industries such as oil and gas can negatively impact sales. However, this cyclicality is mitigated by geographic diversification, the diversity of end user markets, the current nuclear upcycle, and a positive political view on the oil and gas industry in the US. Additionally risk mitigation is offered by the fact that a significant percentage of the business is aftermarket/MRO which is less cyclical.

Segment Tailwinds Velan serves sectors that are expected to see substantial growth over the next several years. Key growth areas include:

Nuclear Energy: Velan is a leading supplier of valves for the nuclear industry. With the growing emphasis on clean energy, nuclear power is expected to play a significant role, which should increase demand for Velan's products. The company has proprietary valve offerings for small modular reactors and a substantial installed base at existing nuclear reactors, which further positions the company to capitalize on increased demand.

Energy Transition: Velan is aligned with the trend towards energy transition. The company's product offerings are relevant in sectors such as LNG, which is a cleaner fossil fuel, and carbon capture, where Velan can play a critical role in the supply chain.

Defense: Velan plans to increase its reach in the defense sector. With global geopolitical instability, it is expected that there will be a greater demand for defense related products and services.

Oil and Gas: The company intends to continue focusing on this market and believes that it is still a key growth area.

Specialized Applications

Velan's expertise extends to specialized applications and the complexity of their products in these areas would be really difficult to copy for an up and coming competitor:

Nuclear: Velan is a key player in the nuclear sector, providing valves used in cooling systems, spray water, and chemistry control. Their valves are designed to meet the stringent quality and safety certifications required by the nuclear industry. Velan's valves for nuclear applications are qualified through a large number of tests and reports, with over 250 qualification reports certified by third parties. They are also developing new technologies for future generations of nuclear reactors.

Cryogenic: Velan offers a portfolio of cryogenic products, including control and isolation valves suited for applications involving LNG and hydrogen. Their cryogenic valves are designed with features such as high elastic restitution for perfect tightness at varying temperatures. They use Viton O-rings and expanded graphite rings for a fire-safe design. Velan cryogenic valves also feature a "no cavity" design to prevent the build-up of solids and allow for in-line servicing.

HF Alkylation: Velan produces valves for HF alkylation processes, which require specialized materials and designs.

Oxygen and Clean Gas Service: Velan also manufactures valves designed for oxygen and clean gas services.

Aftermarket Services

The aftermarket services is a profitable business segment that takes advantage of the massive installed base of Velan’s valves across the world. What they do in this area involves:

Repair and Refurbishment: Velan offers valve repair and refurbishment services. Their service program is supported by authorized service and modification shops.

On-Site Service: They provide on-site service for Velan valves, including commissioning, troubleshooting, process start-up studies, and valve repair.

Spare Parts: Velan offers OEM spare parts that are manufactured to their stringent quality standards for easy replacement. These parts are stocked at locations around the world to provide competitive lead times and expedited shipping.

Engineering Support: Velan offers engineering support, including analysis and know-how. Their service engineers can assist with valve and material specifications, maintenance recommendations, and allowable operating parameters.

Technical Support: Velan has a Technical Services department that maintains a database of product applications to support continuous improvement. Their service also helps maintenance personnel troubleshoot valve problems with their massive knowledge base.

Field Services: The company provides field service capabilities, such as in-line seat removal, seat welding, and lapping.

Velan’s Presence Around the World

Velan operates 12 manufacturing plants worldwide. These plants are strategically located across North America, Europe, and Asia.

More specifically, Velan's manufacturing footprint includes:

North America: 3 plants. Two plants are in Canada, and one is in the United States. One of the Canadian facilities is located in Granby, Quebec and another is in Montreal. The U.S. plant is in Williston, Vermont.

Europe: 4 plants. There are two plants in France (which are going to be divested if the transaction with Framatome closes in H12025), one in Italy, and one in Portugal. The two French facilities are located in Lyon and Mennecy, while the Italian facility is located in Lucca, and the Portuguese facility is in Lisbon.

Asia: 5 plants. Two plants are in South Korea, and one each in Taiwan, China, and India. The two South Korean plants are located in Ansan City. The Taiwanese plant is in Taichung, the Chinese plant is in Suzhou, and the Indian plant is in Coimbatore.

Velan also has two stocking and distribution centers, one in Houston, Texas, U.S.A. and the other in Willich, Germany. In addition, there are hundreds of distributors and over 60 service shops worldwide.

Velan has consolidated its North American manufacturing operations from four plants to three. This consolidation was part of a restructuring plan referred to as V20, which aimed to improve operational efficiency. As part of this restructuring, production of certain non-project valves produced in North America and less complex project valves were transferred to India. In addition, the company has also made adjustments to its manufacturing footprint in response to market demand. For example, one plant in Suzhou, China was certified to produce API 6D valves, allowing the plant in Lucca, Italy to focus on high-end products.

Customers

Customer Concentration While the company has been diversifying its customer base, concentration is still an important factor.

The financials of the company show a notable trend of customer concentration in its trade accounts receivable. As of February 29, 2024, the data highlights an improvement in diversification with two customers each accounting for more than 5% of receivables, notably lower compared to 2023 where four customers exceeded this threshold, including one at 15%.

However, by November 30, 2024, this pattern had reversed somewhat, with an increase to five customers each representing over 5% of receivables and one customer alone accounting for 11.2%.

During the same period, the top ten customers combined represented 56.7% of the total trade accounts receivable, pointing to a persistent issue of high customer concentration, although it has decreased from previous years.

While this customer concentration poses a risk, it also suggests that Velan has secured significant contracts with key clients in critical industries.

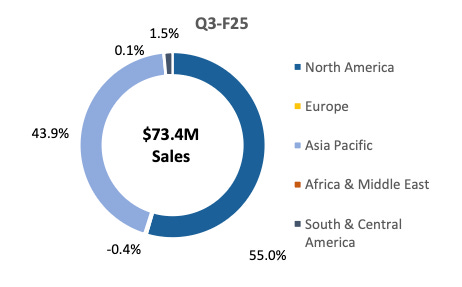

After the divestiture of the french assets, Velan’s sales by customer location are the following:

Pricing Power It depends on which type of valves and in which industry. In general, Velan faces some limitations in its ability to raise prices at will. The company operates in a competitive market, and competes with manufacturers in low-wage countries that offer valves at substantially lower prices. This means that Velan is not always a price maker.

The company acknowledges that it may not always be able to pass on increases in raw material costs to its customers. This means that its pricing power is limited by its cost structure and competition.

On the other hand, Velan's focus on custom-designed complex solutions for demanding applications and its preeminent brand globally may allow it to command premium prices in certain market segments such as defense or nuclear. But since the company does not report business segment data, it is difficult to assess overall pricing power capability.

There is an interesting opportunity though, in which management plans to take action in the coming quarters, within the after-market MRO. The company's brand and installed base also allow them to be more of a price maker here, increasing segment margins.

Recent Important Announcements

Velan has recently announced several significant agreements with key clients and partners, primarily in the nuclear sector, which indicate a strategic focus on leveraging its expertise and products in this growing market. These agreements include strategic partnerships, supply agreements, and memorandums of understanding (MOUs) that position Velan for continued growth in the clean energy sector.

Here’s a detailed summary:

Bruce Power Alliance Agreement:

Velan signed a 10-year alliance agreement with Bruce Power, one of Canada's largest nuclear power operators. This is a long-term supply agreement, where Velan will provide high-performance valves and related services.

This alliance agreement is valued at $50 million and could be expanded to $100 millions.

GEH SMR Technologies Canada Agreement:

Velan entered into a Masters Services Agreement (MSA) with GEH SMR Technologies Canada Ltd. to supply valves for a stand-alone small modular reactor (SMR) for Ontario Power Generation (OPG).

Under the agreement, Velan will provide GEH with advanced technology, engineering support, and leading-edge valves essential for the safe and efficient operation of the first BWRX-300 SMR. The initial order also includes a provision for three additional units to be deployed, with completion expected by 2034.

Westinghouse MOU:

Velan signed a memorandum of understanding (MOU) with Westinghouse to support nuclear newbuild projects in Canada and around the world.

Westinghouse is a significant player in the nuclear power market, with roughly 50% of the global reactor fleet and is actively developing SMRs and microreactors. This MOU offers Velan growth opportunities for its valve and flow control equipment.

This agreement indicates a strategic alliance with a major nuclear technology provider, leveraging their established position in the nuclear market.

This is an extension of past agreements, with Velan increasing its penetration in the nuclear market.

What Does This All Means for Velan? All these agreements signify a long runway of revenue for Velan, implying:

Focus on Nuclear: These agreements underscore Velan's strategic focus on the nuclear energy sector, aligning with the growing global demand for clean energy solutions.

Long-Term Growth: The long-term nature of these agreements, especially the 10-year Bruce Power alliance and the multiple unit provision with GEH, provides Velan with long-term revenue opportunities.

Technology Leadership: Velan’s proprietary valve technology, particularly for small modular reactors, is a key differentiator.

Global Reach: The agreements with Westinghouse and other international partners demonstrate Velan's ability to secure newbuild projects globally.

The Industry: Flowing Against the Tide

Velan operates in the industrial flow-control industry, which is cyclical and closely tied to capital investment in energy and infrastructure.

Current industry trends are mixed-positive. On one hand, global energy infrastructure spending (especially in LNG, downstream oil & gas, and chemical processing) has been recovering, which drives demand for new valves. Velan’s increase in bookings in regions like North America and Germany for oil and gas projects reflects this trend. The nuclear power segment is also a niche strength for Velan – with a global push for low-carbon energy, maintenance and new-build activity in nuclear has provided opportunities.

On the other hand, the industry faces challenges: supply chain disruptions and inflation have been significant in recent years. Velan cited logistics and operations problems (e.g. shipping delays, component shortages) that impacted deliveries in 2022. Cost inflation in materials and labor (the price of raw materials, particularly steel, represents a significant portion of the cost of manufacturing valves) can squeeze margins if not passed to customers, although Velan’s recent results show margin improvement as some pressures eased or were managed.

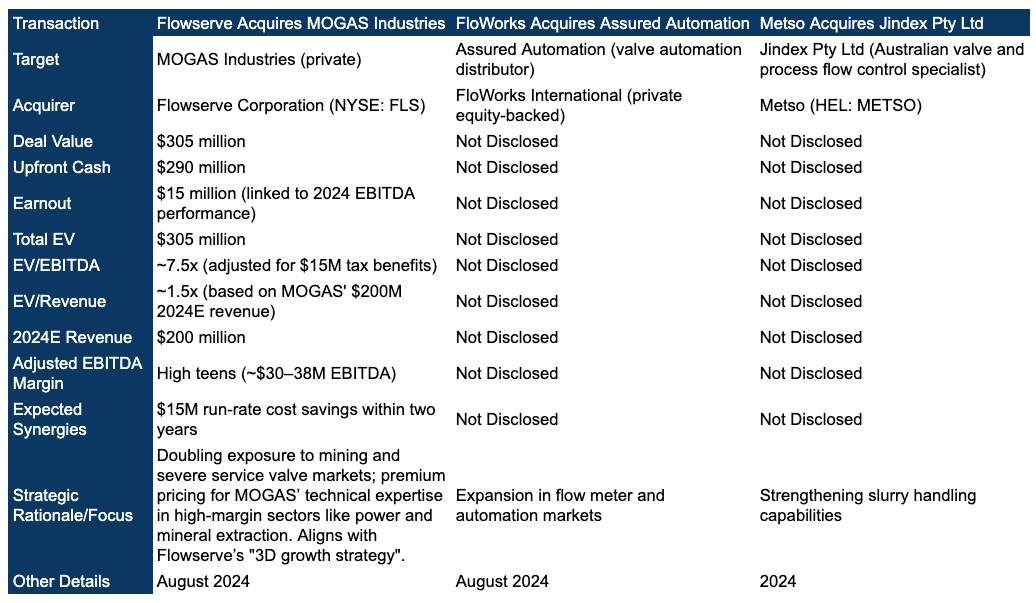

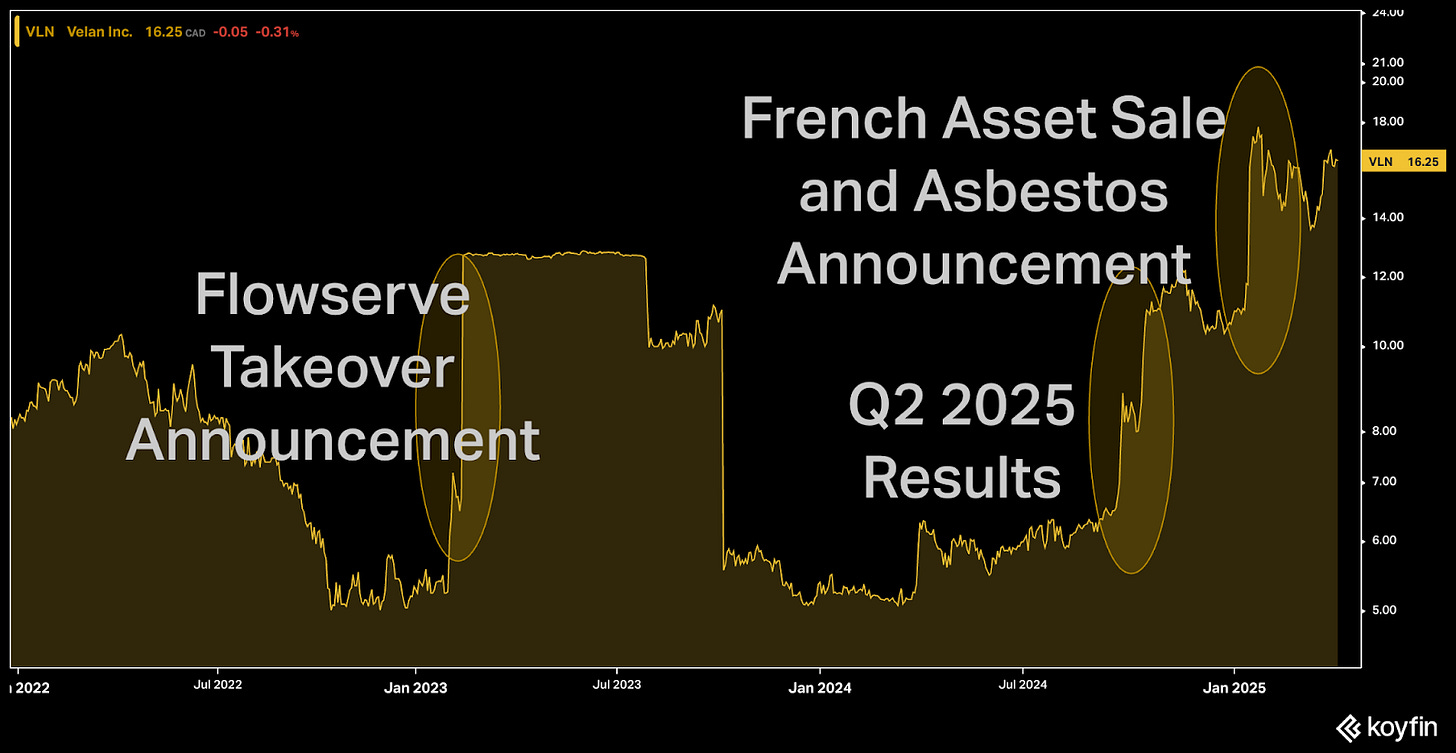

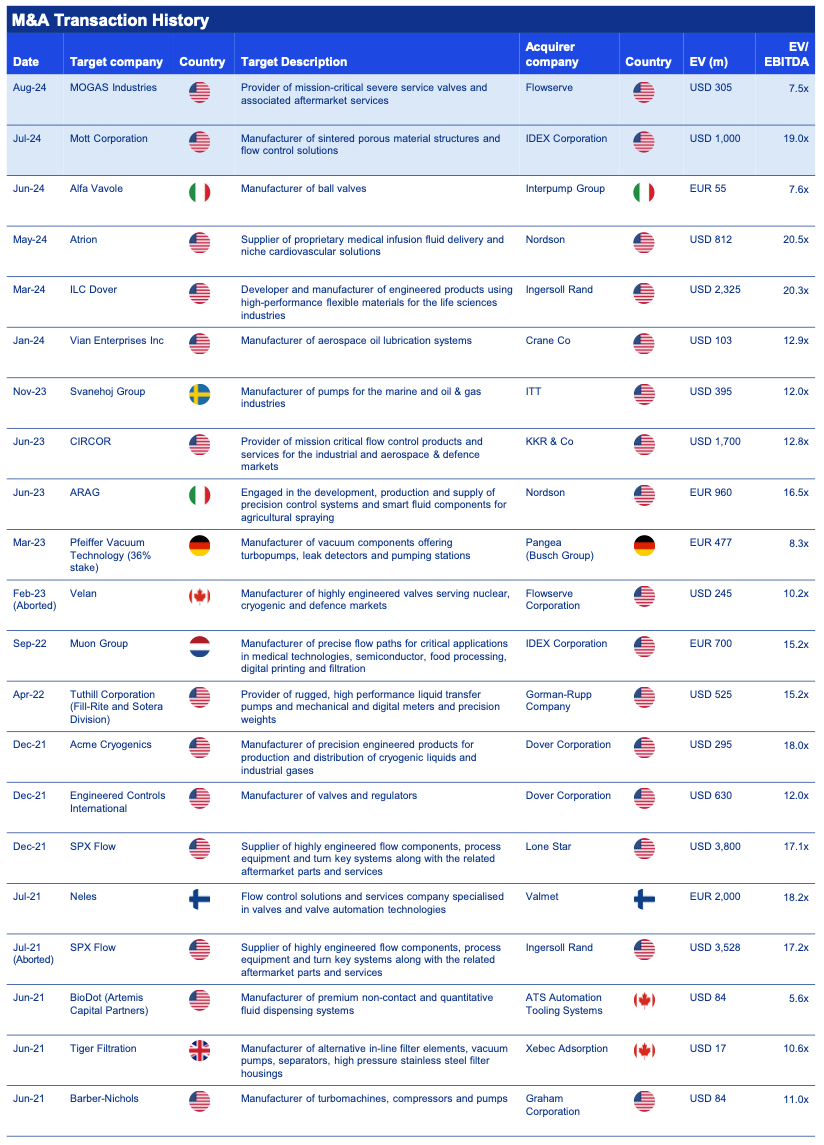

Competition in the valve industry is another key factor. Velan’s competitors include much larger diversified players like Flowserve, Emerson (Fisher valves), Crane Co., and IMI/KSB, as well as specialized local manufacturers. The competitive landscape is global and intense on large projects, often based on technical qualifications, performance track record, and price. Velan has carved out a reputable position, especially in high-end applications (its brand is often associated with quality in severe service and nuclear valves). Industry consolidation is an ongoing trend – the attempted acquisition of Velan by Flowserve is indicative of larger players looking to expand product lines via M&A.

The industry is broadly divided between manufacturers of standard commodity valves and those producing highly engineered valves like Velan. Competition is typically more intense in the commodity valve segment, while the engineered valve segment experiences relatively less competition.

Competitors

Velan operates in a highly competitive and fragmented global industrial valve market, facing various competitors across different segments. Below are some examples:

Core Competitors

Flowserve Corporation (USA): A century-old leader in engineered valves for oil/gas, chemical, and power industries, known for customized solutions and robust R&D.

Emerson Electric (USA): Dominates automation and valve tech with innovations in diagnostics and control systems, serving sectors like water management and petrochemicals.

Specialized Valve Manufacturers

IMI plc (UK): Focuses on precision fluid control valves for power generation and life sciences, emphasizing energy efficiency.

Cla-Val (USA): Competes in industrial machinery with strong regional presence in flow control systems.

Hy-lok (Canada): Edmonton-based rival in industrial suppliers.

Severe Service Valve Focus

KSB Group (Germany): Global leader in pumps/valves for extreme conditions, overlapping with Velan’s nuclear and petrochemical markets.

Bray International (USA): Provides automation-ready valves for harsh environments, including cryogenic and high-temperature applications.

In general, Velan differentiates through nuclear-grade valves and forged steel products for severe service, but faces pricing pressure from cost-efficient Asian manufacturers like Plumberstar.

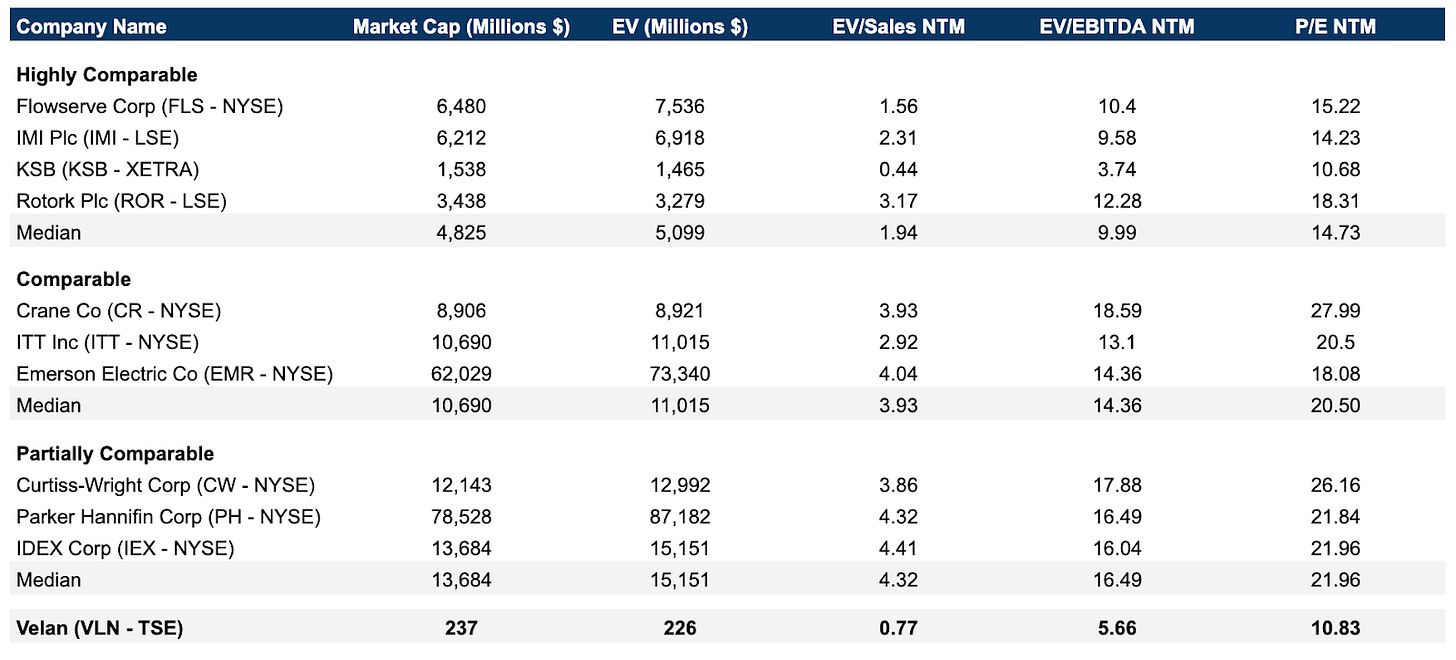

Industry Benchmarking

With the divestitures, Velan’s scale and financial metrics will shift, so it’s important to compare Velan’s performance and positioning relative to peers in the flow control and industrial valve sector. Key competitors include large players like Flowserve Corporation (FLS), which is a global pump and valve manufacturer, as well as regional players such as KSB SE & Co. (a German pump/valve firm), and other valve specialists. Below is a benchmarking of Velan versus these peers on several dimensions:

Revenue Size & Growth

Velan’s annual revenues (pre-divestiture) were $346.8 million in FY2024 , making it a mid-sized player in the valve industry. Post-sale, revenue will drop (roughly to the $250–$300 million range). In contrast, Flowserve’s revenues are on the order of $4 billion annually – an order of magnitude larger – and KSB’s revenues were about €2.8 billion in 2023 (approx $3.0 billion). Thus, Velan will be a niche player compared to these giants.

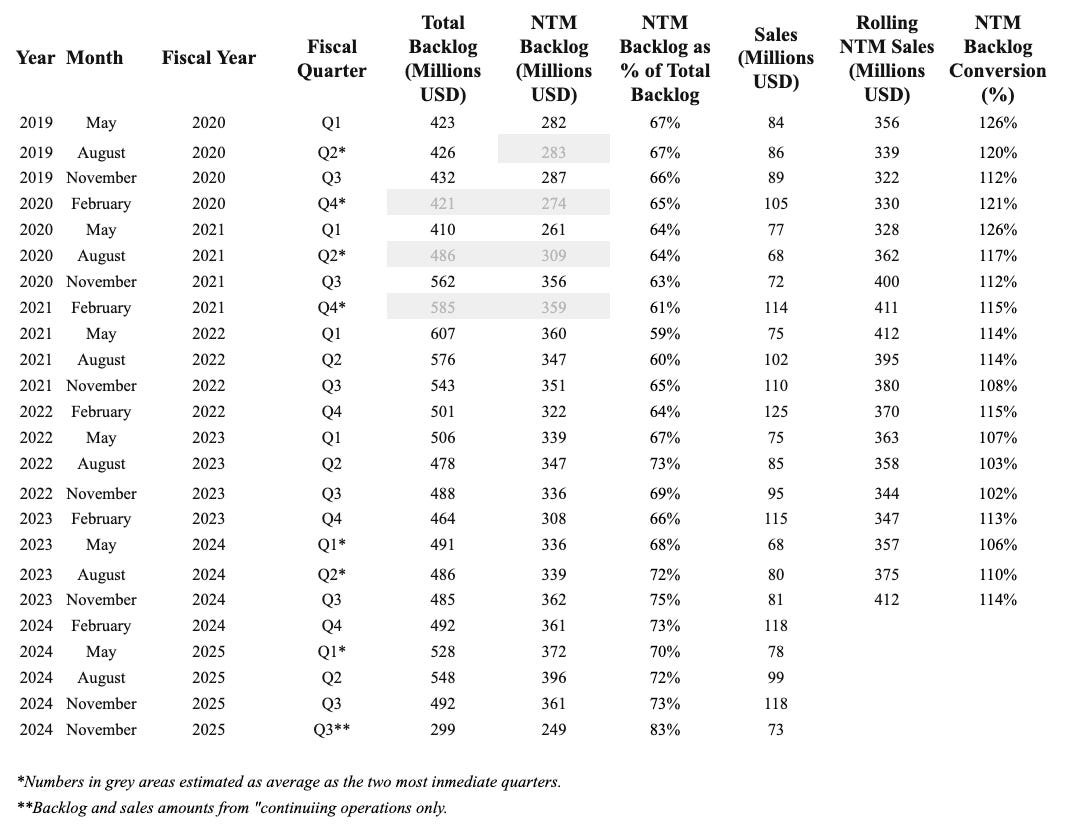

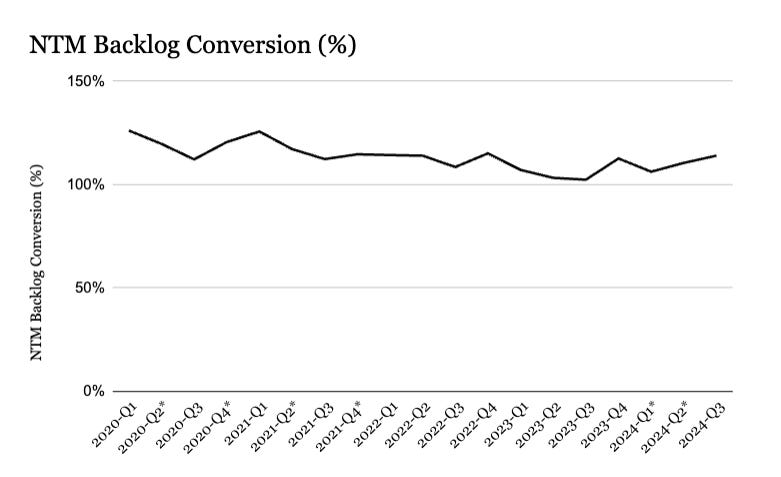

Flowserve’s revenue growth for 2024 was close to 6%, and it is forecasting further growth in 2025. In short, Velan’s growth has lagged the industry average recently. However, Velan’s order backlog tells a more positive story – it reached a record $491.5 million at Feb 2024 (which is 1.4x its FY2024 sales), indicating that Velan had new business in the pipeline.

The challenge has been converting that backlog to revenue. Peers like Flowserve also built strong backlogs during the same period (Flowserve reported record backlog entering 2024, given robust orders for energy projects). The industry overall is in an upswing due to energy infrastructure and maintenance cycles, so Velan is operating in a growing market.

Post-divestiture, Velan will lose the portion of backlog and growth associated with its French nuclear business, but it will still participate in global nuclear/industrial markets outside France, where demand (e.g., small modular reactors, LNG, etc.) is growing. Bottom line: Velan will be much smaller than leading competitors and needs to improve its execution to keep pace with peers’ growth rates.

Profitability and Margins

Velan’s profitability has historically been below peers’ levels. In FY2024, Velan’s gross margin was 26.9% and its EBITDA margin (adjusted) was around 5%. On an IFRS basis, operating margin was near 0% (essentially break-even before special items).

By contrast, Flowserve’s gross margins and operating margins are higher. Flowserve’s gross profit margin was about 31.5% in 2024, and it achieved an operating margin of roughly 10.6% in Q42024. Flowserve is targeting operating margins of 10%+ in the near term and 14–16% long-term, reflecting far better efficiency.

KSB likewise improved profitability – KSB's EBIT margin increased from 7.9% in 2023 to 8.2% in 2024, whereas it was closer to 3% in 2022. Even mid-sized peers that were public (e.g., CIRCOR International before it was taken private) operated with EBITDA margins in the low double-digits.

Velan, in contrast, has struggled to consistently generate profits: it posted net losses in each of the last two fiscal years. Even on an adjusted basis, Velan’s FY2024 return on sales was barely positive. One reason is that Velan’s cost structure was burdened by litigation and some underperforming operations (issues now being resolved). Also, as a smaller company, Velan may lack the economies of scale that larger players have in manufacturing and procurement.

Post-divestiture margins: It’s possible that Velan’s margins could improve once the remaining business is more focused and freed from legacy costs. The French business being sold was actually a relatively high-margin niche (serving nuclear clients who typically pay for quality), so losing that might slightly dilute Velan’s gross margin. However, Velan’s continuing operations showed strong margin improvements recently – for instance, in Q3 FY2025, the continuing ops gross margin was 38.6% (helped by a favorable sales mix), demonstrating that the remaining business can achieve healthy margins.

If Velan can sustain mid-30s gross margins and streamline overhead, it could target high EBITDA margins, closer to peers. At present though, Velan significantly trails competitors in profitability. This is an area where management needs to execute better to be competitive. The removal of interest expense (due to no debt) will help net margins, but the real gap is at the operating level, where Velan must reduce costs and improve productivity to approach peers’ margin levels.

Debt and Leverage

Velan (post-transaction) will have virtually zero debt, which is a very strong position relative to peers. Velan historically had modest debt – even before these deals.

After the French assets sale, Velan will extinguish this debt and likely hold net cash. In comparison, Flowserve carries a higher debt load (as a large company it has issued bonds and uses credit lines). Flowserve’s net debt was roughly $500–600 million in recent years, resulting in a net debt/EBITDA ratio of about 2x, and it maintains an investment-grade credit rating (BBB-).

KSB tends to be more conservatively financed; it often runs with a net cash or low-net-debt position (many German industrials are relatively low-leveraged).

Smaller U.S. peers like CIRCOR had much higher leverage (which contributed to them being acquired by private equity). So Velan’s debt level is more conservative than the industry norm – many industrial manufacturers carry some debt to optimize capital structure, whereas Velan will have virtually none. This means Velan has lower financial risk and interest costs than peers, but it also means potentially a less “efficient” balance sheet (excess cash yields low returns).

That said, given Velan’s challenges with profitability, being debt-free is prudent. It cannot currently support heavy debt service, so this clean balance sheet is a competitive advantage in terms of resilience. In any downturn or if projects get delayed, Velan won’t have creditors at the door. Peers like Flowserve with higher fixed obligations need to be more careful in downturns.

In summary, Velan will be one of the few essentially debt-free companies in its sector, trading higher financial safety for lower leverage. This positions it well to weather economic cycles and possibly gives it capacity to raise debt later if needed for expansion.

Free Cash Flow Generation

Velan’s track record on free cash flow has been mixed. In FY2023, Velan had negative operating cash flow (due to the big asbestos payout and working capital needs), and in FY2024, cash flow improved but was still only around breakeven over the full year (operating cash was slightly positive, and after capex, FCF was likely near zero).

Peers generally have better FCF. For example, Flowserve in 2023 improved its cash generation – by Q3 2024, Flowserve highlighted “meaningful… improvements in cash flow” and was on track for strong full-year FCF as margins rose. KSB’s business, being project-based, also has fluctuations, but its profitability uptick in 2023 means it likely converted more of earnings into cash.

Velan did show an encouraging trend in the first half of FY2025: $15 million operating cash flow in six months, thanks to higher earnings and better working capital management. If that trend continues, Velan’s free cash flow in FY2025 could be solidly positive – a welcome change.

Relative to peers, Velan’s cash conversion had been poor (due to low earnings and significant inventory builds). The benchmark to aim for: peers like Flowserve typically convert a good portion of EBITDA to cash (Flowserve’s FCF margin has been in the mid-single digits as a % of sales). KSB reported a free cash flow of €100+ million in 2022 despite lower margins, which is ~3-4% of sales.

Velan’s FCF as a % of sales has been near 0% or negative recently, so there’s room for improvement. With no dividend drain (Velan’s dividend is minimal) and no asbestos payments going forward, nearly all operational cash can feed growth or actual free cash.

Strong free cash flow is an area where the best industrials (like some peers) differentiate themselves, and it remains a goal for Velan to achieve consistent positive FCF.

Market Position and Focus

Velan’s product portfolio is centered on industrial valves for demanding applications (especially in nuclear power, oil & gas, and other energy or industrial processes).

In its niches, Velan has a strong reputation – for example, it’s a leading supplier of valves for nuclear reactors globally, with proprietary designs and a large installed base. However, after selling the French units, Velan will exit the direct servicing of France’s nuclear industry (since Framatome will own those businesses).

Velan will still supply nuclear valves in North America (where it has worked with clients like Ontario Power Generation) and elsewhere. This leaves Velan as a major North American player in nuclear valves at a time when nuclear power investment is increasing (small modular reactors, life extensions of plants, etc.).

Competitors in nuclear valves: Flowserve also serves the nuclear sector (Flowserve’s Vogt and Edward valves, for instance, compete in that space), as do Japanese firms and smaller specialists. With Framatome taking over Velan’s French operations, Velan may actually partner or compete with Framatome internationally.

Outside of nuclear, Velan makes valves for oil & gas, LNG, petrochem, and general industry. Here it faces big competitors: Flowserve, Emerson (which owns valve brands like Fisher), Crane Co., IMI plc, Sampson, KITZ (Japan), etc.

Velan’s post-divestiture market positioning will be as a focused, high-end valve maker, but with a smaller geographic footprint. It will have manufacturing in North America, and likely still some presence in Asia (Velan has plants in Korea and Taiwan, etc., plus a minority stake in an Indian JV if still retained).

The French sale does concentrate Velan’s market: essentially North America, India, and some other export markets.

Relative to competitors’ market share: Flowserve and Emerson are far larger and offer full flow-control solutions (pumps, seals, automation, etc.), whereas Velan is primarily valves. This means Velan often serves niche roles or is a second-tier supplier on global projects.

The company emphasized that it “continues as a leader in flow control solutions for clean energy and other industrial sectors” and that it is “well-positioned… in the clean energy sector, including nuclear”. Velan’s strategy is to double down on niches where it can be a leader, rather than try to match the breadth of Flowserve.

Customer base and project wins: Velan has historically secured large orders. Peers like Flowserve also announce large project bookings (Flowserve recently won >$100M in nuclear awards in one quarter). So in the marketplace, Velan can compete for critical-service valve orders, often leveraging its technical expertise.

Capital Allocation and R&D

Comparing how Velan and its peers invest and return capital can provide insight into management priorities.

R&D Investment: Velan’s R&D expenditure was about $6.2 million in FY2023 (with net $4.8 million after tax credits). This is roughly 1.7% of sales. In FY2024, it was $6.06 million (with net $4.73 million after tax credits).

Large peers typically invest a bit more: Flowserve spends roughly 2–3% of sales on engineering and R&D (which would be on the order of $80–$100 million for Flowserve).

KSB also invests in product development for pumps/valves at a few percent of sales. So Velan’s R&D intensity is slightly lower, but not dramatically so for an equipment manufacturer.

The company likely relies on its decades of engineering experience and customer-specific development (often funded as part of projects) rather than big central R&D budgets. Post-divestiture, Velan has indicated it will be looking at “greater investments in growth opportunities” – which likely includes product development in some advanced areas (for example, advanced nuclear valve technology, hydrogen service valves, carbon capture-related equipment, etc.). Being debt-free means Velan can allocate more cash to R&D if needed.

M&A Activity

Velan’s capital allocation so far has been conservative – no major acquisitions (the last notable one was years ago when it acquired partial stakes in some foreign entities like Segault and ABV). In fact, Velan just completed the buyout of the remaining 25% minority in Segault in September 2023 for €4.7M, only to now sell Segault entirely to Framatome. So Velan’s M&A has been more tactical.

Post-deal, with cash available, Velan could consider strategic acquisitions. We might see Velan shift to a growth-through-acquisition mindset once it stabilizes – something peers have done to great effect in the fragmented flow control sector, if it’s not taken over.

Shareholder Returns (Dividends/Buybacks)

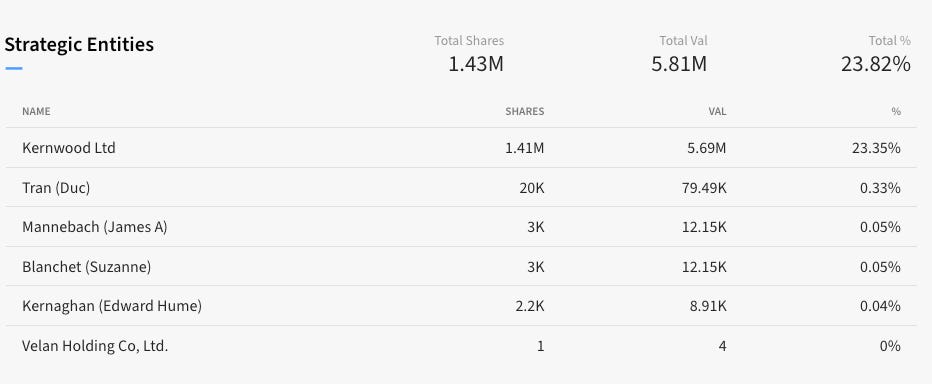

Velan’s shareholder return policy has been minimal. The company has traditionally paid only a token dividend – for example, a $0.03 CAD per share dividend was declared in the recent quarter. This is a very small payout (Velan’s stock trades in the teens, so $0.03 CAD is a fraction of a percent yield).

In some years, Velan skipped dividends when losses mounted, indicating it’s not committed to a steady payout. No share buyback programs have been notable, and the share count has remained stable (21.6 million shares), implying no significant repurchases. In contrast, many peers reward shareholders more directly.

Flowserve, for instance, pays a regular quarterly dividend (approximately $0.21 per share, about a 1.34% annual yield at recent prices) and has engaged in share buybacks in the past when cash flow allowed. Other industrial peers also tend to return capital via dividends in the 1–3% yield range and occasional buybacks.

Velan’s approach reflects its priority to conserve cash for operations – understandable given its recent turnaround efforts. After becoming debt-free, Velan might reconsider its capital return policy, but given its focus on growth, significant dividends or buybacks are likely not immediate priorities.

Instead, any excess cash will probably be used to strengthen the business rather than be distributed, at least until consistent profitability is achieved. From an investor’s perspective, Velan’s total shareholder return historically lagged peers – not just due to limited dividends, but also because the stock’s performance was lackluster prior to the attempted Flowserve buyout (which gave a one-time boost).

Peers like Flowserve or KSB, while not high-flyers, delivered some return via dividends and stock appreciation as their earnings grew. Velan’s future attractiveness to investors will depend on it closing the profitability gap; with the risk reduction achieved by these transactions, Velan may now trade more in line with industry averages on metrics like EV/EBITDA, but it must deliver results to earn a peer-like valuation.

In sum, Velan trails its industry peers in growth and profitability, although it is moving to correct that by shedding distractions and liabilities.

Its peers set a benchmark of mid-to-high single-digit operating margins and steady growth – targets that Velan’s management will strive to reach in the coming years. The recent strategic moves give Velan a fighting chance to improve and perhaps eventually re-attract acquisition interest (possibly from another peer) now that the French regulatory hurdle is sidestepped by selling the French operations separately.

At the very least, industry benchmarking shows where Velan needs to improve (margins, growth) and where it stands out (balance sheet strength, niche leadership).

The Moat: Pressure-Tested Protection

Velan's competitive advantage stems from several sources that create a moat around its business. It depends on the business segment, but these advantages are not easily replicable by competitors and contribute to its long-term viability and profitability:

Global Reach and Diversified Operations: Velan operates manufacturing facilities in nine countries and serves clients in over 60 countries. This global footprint provides diversification, reducing reliance on specific markets, and allows for capturing growth opportunities worldwide. This is a key competitive advantage as some clients demand local manufacturing and supplies.

Stringent Quality and Safety Certifications: The company holds ISO 9001 and ASME certifications. These certifications are essential in demanding industries such as nuclear power and petrochemicals. Meeting these standards is costly and time consuming, making it difficult for new entrants to compete.

Reputation for Quality and Reliability: Velan's products are known for their quality and reliability, especially in critical applications. This reputation, built over 75 years, leads to customer loyalty and long-term contracts, providing a stable customer base. Velan was a supplier in the first nuclear reactor built in the US.

Expertise in Demanding Applications: Velan specializes in creating custom, complex solutions for demanding applications. This expertise, developed over decades, is difficult to replicate and caters to specialized customer needs, particularly in sectors like nuclear and cryogenic industries. The focus on engineered solutions allows them to command a higher price for specialized products.

Proprietary Technology in Nuclear Sector: Velan has proprietary valve offerings for small modular reactors (SMRs) and a large installed base of valves in existing nuclear reactors.

Operational feedback: Velan has been developing valves in cooperation with clients for 20 or 30 years, this generates a virtuous cycle difficult to replicate.

Installed Base: Velan's substantial installed base at existing nuclear reactors provides significant potential for maintenance, upgrades, and life-extension projects. This creates a recurring revenue stream and further cements customer loyalty and provides an advantage as customers will be more likely to choose the same company to provide services or new valves for their installed equipment.

Stability and trajectory: Finally, clients planning for critical valve procurement want to be sure that they can count on the supplier in the future when they need spare parts and maintenance. Velan 75 years of history assures them about that.

Above all, clients look for quality and safety. Velan’s long reputation in this area plus the certifications is something that could take years for a new competitor to replicate.

There’s also high switching costs after a customer opts for Velan. This is due to:

Customized Solutions: Velan provides tailored solutions, meaning a switch to a different provider requires re-engineering and qualification of new valves, which can be expensive and time consuming.

Quality and Reliability: Switching to a less established provider could lead to costly operational disruptions and safety concerns.

Regulatory Requirements: In industries like nuclear, the regulatory hurdles of switching suppliers are very high as new equipment would need to be re-certified.

Installed Base: Customers with a significant installed base of Velan valves benefit from economies of scale from both a maintenance and operations perspective. Switching to an alternate supplier would disrupt this.

In conclusion, Velan has several layered advantages that collectively form a good moat around its business. Its global presence, reputation for quality, expertise in critical applications, certifications and proprietary technology in the nuclear sector provide significant barriers to entry for competitors. While the company faces challenges from low-cost manufacturers and must manage material cost risks, its strategic initiatives are making sure that they keep these challenges at bay.

Nuclear Dominant Position

Nuclear is a special segment for Velan, as they are leaders in the industry. Velan has an installed base of thousands of valves in over 300 nuclear power plants. Many of these valves continue to operate after more than 40 years of uninterrupted service.

If we consider that there are 440 active reactors worldwide, then that’s at least 70% market share. Velan valves are installed in 98% of American and French nuclear power units, and all British and Canadian units.

Adding to this, Velan has valves installed in more than 950 US Navy and NATO ships, all US Navy nuclear submarines, and nuclear aircraft carriers and 22 French nuclear submarines.

If we think about nuclear technologies, Velan is a leading valve supplier for all of them:

Their valves are installed in all CANDU (PHWR) stations, in a majority of PWR and BWR stations, and in many other reactor types including GCR, AGR, LGR, VVER, HTGR and LMFBR.

Velan has longstanding experience in reactor technologies such as PWR, EPR, VVER, HUALONG, AP1000, BWR, PHWR, CANDU, FBR, AGR, and HTR.

Growth Levers: Backlog to Breakthrough

Velan Inc. has several favorable growth prospects, driven by strategic initiatives and market conditions, with a focus on specific sectors and a commitment to increasing shareholder value.

Organic Growth

Velan has multiple avenues for organic growth, supported by its existing market position, strategic initiatives, and industry trends. Here's a detailed breakdown:

Nuclear Sector Expansion

Growing Market: The global nuclear sector is experiencing a multi-year growth cycle, driven by the increasing demand for clean and sustainable energy sources.

Existing Installed Base: Their extensive installed base provides a strong foundation for repeat business through maintenance, upgrades, and life-extension projects.

Small Modular Reactors (SMRs): Velan is well-positioned to capitalize on the emerging SMR market with its proprietary valve offerings. They have secured agreements and alliances with key players like GEH and Westinghouse, indicating a first-mover advantage in supplying SMRs.

Nuclear Navy: Velan is the only manufacturer to supply nuclear valves to all US Navy nuclear aircraft carriers and submarines, providing an exclusive channel for continued growth in this sector, albeit US tariffs could generate some noise in the relationship.

Life Extension and Renewal: Velan is also focused on the market for life extension and renewal of existing nuclear power plants, which provides additional opportunities given their existing installed base.

Geographic Expansion

Emerging Markets: Velan is targeting growth in emerging markets in the Asia-Pacific, Africa, and Middle East regions, where investments in energy and industrial infrastructure are increasing.

Localization of Production: The company is establishing local production capabilities in strategic markets to reduce costs, improve delivery times, and respond more effectively to local customer needs. This approach also facilitates quicker response times to localized projects, and provides support in different languages.

Partnerships and Joint Ventures: Forming strategic partnerships and joint ventures with local companies strengthens Velan's presence in these regions. For example, the joint venture with a Saudi partner in Velan's Italian operations has helped the company establish a presence in the Middle East, which is the largest valve market in the world.

Distribution Network: They have a distribution network of hundreds of distributors worldwide which helps broaden their reach, and may be a lever for growth in existing and new markets.

Diversification into Other Sectors

Renewable Energy: Velan can supply valves and control solutions tailored to wind and solar energy infrastructure. For example, solar thermal power plants require robust valves for high-temperature fluid management.

Hydrogen: Velan can develop cryogenic valves and control solutions for the production, storage, and distribution of hydrogen, which is becoming a viable option in the energy transition.

Oil and Gas: Velan has a strong presence in the oil and gas sector, with a customer base spanning approximately 90% of North America's oil refineries and a growing presence throughout the world.

LNG and Cryogenics: The company's portfolio of cryogenic products, including control and isolation valves, positions them to capitalize on the growing demand for LNG and hydrogen.

Carbon Neutral Technologies: Velan sells valves designed to reduce fugitive emissions, and is dedicated to environmentally driven solutions.

New Product Introductions: Velan is also introducing new products, such as the Torqseal® 2.0 triple offset valve, to meet evolving industry needs. They also have a dedicated coatings research division.

In summary, Velan Inc. has favorable growth prospects driven by a focus on high-growth sectors and strategic expansion. Now let’s take a look at the strategic initiatives the company is undertaking that could contribute in a big way to improved profitability.

Strategic Initiatives

Velan has recently undertaken several strategic initiatives aimed at improving its margins, including both operational and financial actions. These initiatives are designed to reduce costs, and increase profitability. Here is a detailed breakdown of these efforts:

Sale of French Subsidiaries

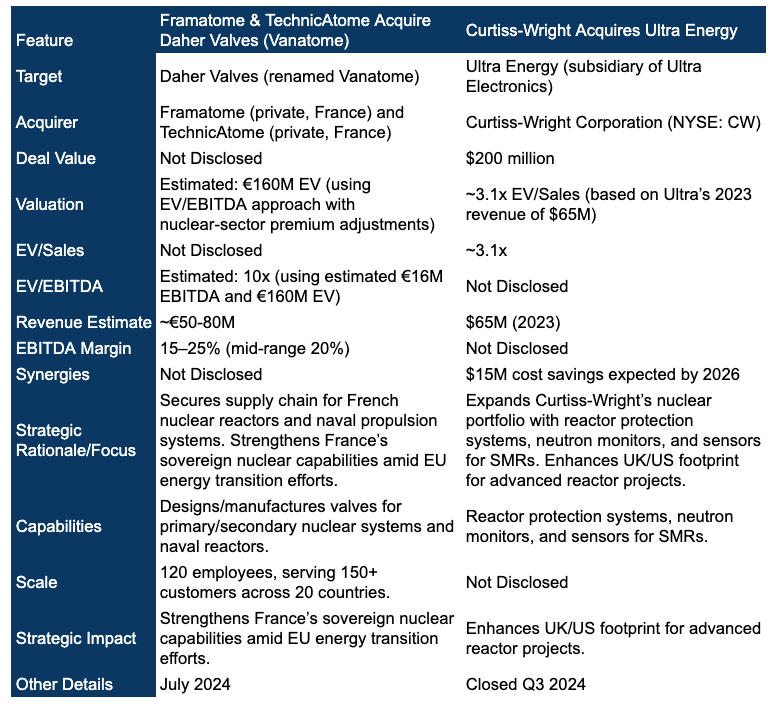

Strategic Rationale: Velan has entered into an agreement to sell its French subsidiaries, Segault and Velan France, to Framatome, a leader in the nuclear energy sector. The transaction now allows them to try to reflect full value for Velan by removing what would be looked at as a protected asset with only a few (French) buyers.

Financial Gains: The transaction is valued at 192.5 million euros (approximately $198.4 million USD), including the transfer of an intercompany loan of 23.2 million USD. This provides a significant cash injection.

Revenue Multiple: The French segment had LTM (Last Twelve Months) revenue of $98 million USD, which puts the transaction multiple at approximately 2x revenue.

EBITDA Multiple: We estimate the multiple of the transaction to be between 18-22x EV/EBITDA range.

Divestiture of Asbestos Liabilities

Strategic Move: Velan has entered into an agreement to divest its asbestos-related liabilities. This involves transferring these liabilities to Global Risk Capital, a specialized liability management company. It is worth mentioning that this transaction is not conditional to selling the french subsidiaries.

Transaction Benefits: removes the risk for any potential buyer and removes an ongoing distraction for management.

Financial Impact: This transaction will eliminate the company's financial exposure to ongoing and potential asbestos-related claims. This reduction in risk is expected to improve the company’s financial stability and overall valuation. The divestiture involves a payment from Velan of $143 million and $7 million from the buyer to capitalize the US subsidiary affected by the lawsuit.

Margin Improvement: By removing these liabilities, Velan can avoid current and future legal and settlement costs, directly contributing to improved profitability and net margins.

Operational Efficiency Improvements

Production Optimization: Velan is modernizing its facilities and adopting advanced technologies to improve productivity, reduce lead times, and lower production costs. This includes the optimization of production processes through investments in technology and infrastructure.

Lean Manufacturing and Six Sigma: The company implemented lean manufacturing principles and Six Sigma methodologies to streamline processes and eliminate waste in recent years. These initiatives are part of a Total Process Improvement Program.

Procurement Efficiencies: Velan is working to capture procurement efficiencies to reduce material costs, although this is still in early stages.

Cost Reduction Measures: The company has implemented cost reduction measures to improve overall operational efficiency and profitability.

Strategic Focus on High-Margin Sectors

Nuclear Sector Growth: Velan is capitalizing on the growing demand for clean and sustainable energy solutions by focusing on the nuclear sector, where it holds a significant market share. The company is well-positioned for a multi-year growth cycle in the nuclear sector.

Proprietary Valve Offerings for SMRs: The company is developing proprietary valve technologies for small modular reactors (SMRs) to capitalize on the emerging market.

Cryogenic Valve Technology: Velan's portfolio of cryogenic products for applications like LNG and hydrogen is a key area of R&D investment. This focus on advanced technology allows for higher margin sales.

Energy Transition Markets: Velan is focusing on other energy-related markets, like oil and gas and LNG, where they can capitalize on customers' net zero objectives.

The V20 Program

Objective: The V20 program was a transformation strategy aimed at improving Velan's competitiveness, leveraging assets, and unlocking bottom-line improvements.

Implementation: The V20 plan was initiated in January 2019, with accelerated deployment even amidst the COVID-19 pandemic.

Key People: Yves Leduc, the CEO at the time, guided the company through the V20 program. The Board of Directors also unanimously approved and supported the V20 plan.

Key Pillars and Strategies:

Manufacturing Consolidation: Velan intended to consolidate its North American manufacturing operations from four plants to three to optimize its manufacturing footprint and improve operational efficiency.

Plant Reconfiguration: Plants in Canada and India were reconfigured for a less vertically integrated manufacturing model.

Customer-Driven Operational Excellence: Emphasis was placed on improving operations to better meet customer needs.

Margin Improvements: The plan aimed to improve margins, particularly in North American operations.

Focus on Key Target Markets: Velan intended to increase its focus on key target markets where it had distinct competitive advantages.

System Modernization: Continuously improving and modernizing Velan's systems and processes was a key goal.

Results: V20 led to highest backlog since fiscal year 2013.

Financial Analysis: Engineering a Turnaround

We will now examine the financial statements prior to the announced transactions, followed by an analysis of the pro forma statements as provided by management.

Pre-Deals Closure Financials

Income Statement

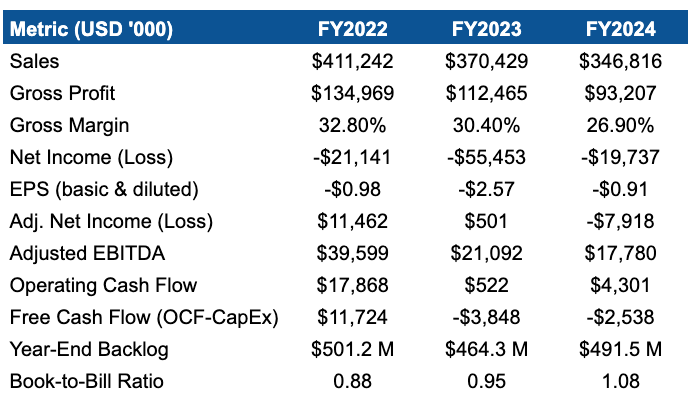

Velan’s sales have declined over the past three fiscal years, from $411.2 million in FY2022 to $370.4 million in FY2023 and $346.8 million in FY2024 (FY2024 ended in 02-2024). Gross profit fell in tandem (from $135.0 M to $93.2 M) as margins compressed (gross margin dropped from ~33% in 2022 to 26.9% in 2024). Net income has been negative each year, with a large net loss of $55.5 M in FY2023 (driven by one-time charges) improving to a $19.7 M loss in FY2024. On an adjusted basis (excluding asbestos provisions and other one-offs), Velan was near breakeven in FY2023 and still posted a slight loss in FY2024.

The key figures are summarized below:

In the past, the company’s revenues have been somewhat cyclical, influenced by project-driven order flow. In FY2024, order bookings increased to $374 M (up ~6% YoY) and backlog reached $491 M (exceeding one year of sales) indicating stronger demand ahead. However, execution delays and supply chain challenges in prior years led to inconsistent revenue – sales declined in both 2023 and 2024 despite a robust backlog.

Having a lower sales volume hurt absorption of fixed production costs, pressuring margins. Going forward, the record backlog gives confidence that FY2025 sales should rebound above FY2024 levels assuming the company can convert orders to shipments more efficiently.

Operating expenses consist primarily of administration costs (which include SG&A and R&D). Excluding unusual items, core admin expenses improved in FY2024 – $86.3 M (24.9% of sales) vs $100.8 M (27.2% of sales) in FY2023 – reflecting cost-cutting and lower freight and commission expenses.

The company’s employee costs make up a large portion of expenses (wages and salaries were $84.1 M in FY2024). Velan also invests in product development; it capitalized ~$2.1 M of development costs in FY2024 (net of R&D tax credits) as intangible assets.

FY2024 adjusted EBITDA was $17.8 M, higher than the $5.3 M EBITDA under IFRS, because $12.5 M of one-time costs (a $10 M asbestos provision increase, $1.3 M in severances, and $1.2 M of acquisition-related costs) were added back. Adjusted EBITDA excludes significant unusual items like asbestos liability provisions, restructuring costs, and transaction expenses.

Overall, while the company has been streamlining operations (e.g. workforce reductions with $1.3 M in severance charges in FY 2024) its profitability is very sensitive to volume because of high fixed overhead.

Balance Sheet

Velan is undergoing a significant transformation through the sale of its French subsidiaries and the divestiture of asbestos liabilities, leading to a strong pro forma cash position and paving the way for a potential sale.

Currently, only 9% of current assets are in the form of cash and that’s mainly because of 3 reasons:

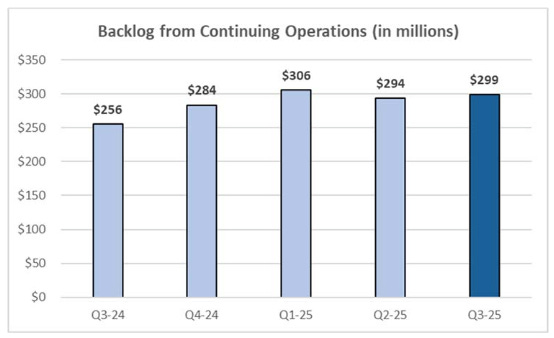

Given their sensitivity to supply chain disruptions, management prefers to carry a higher level of inventory than usual. Let’s remember that we also have a backlog of approximately $250 million deliverable in the next 12 months. Below is total backlog evolution for the continuing operations after the divestitures.

There’s a portion of assets held for sale, namely the French assets.

Following the completion of the sale of the French subsidiaries and the divestiture of asbestos-related liabilities, management anticipates a pro forma cash and cash equivalents balance of approximately $65 million. This projection is based on the understanding that the company will receive net cash proceeds of approximately $30 to $32 million from the two transactions.

With the assets for sale gone, additional cash generated during the quarter and the net positive proceeds after the two transactions, we expect a much better looking balance sheet in Q4 2025 or Q1 2026.

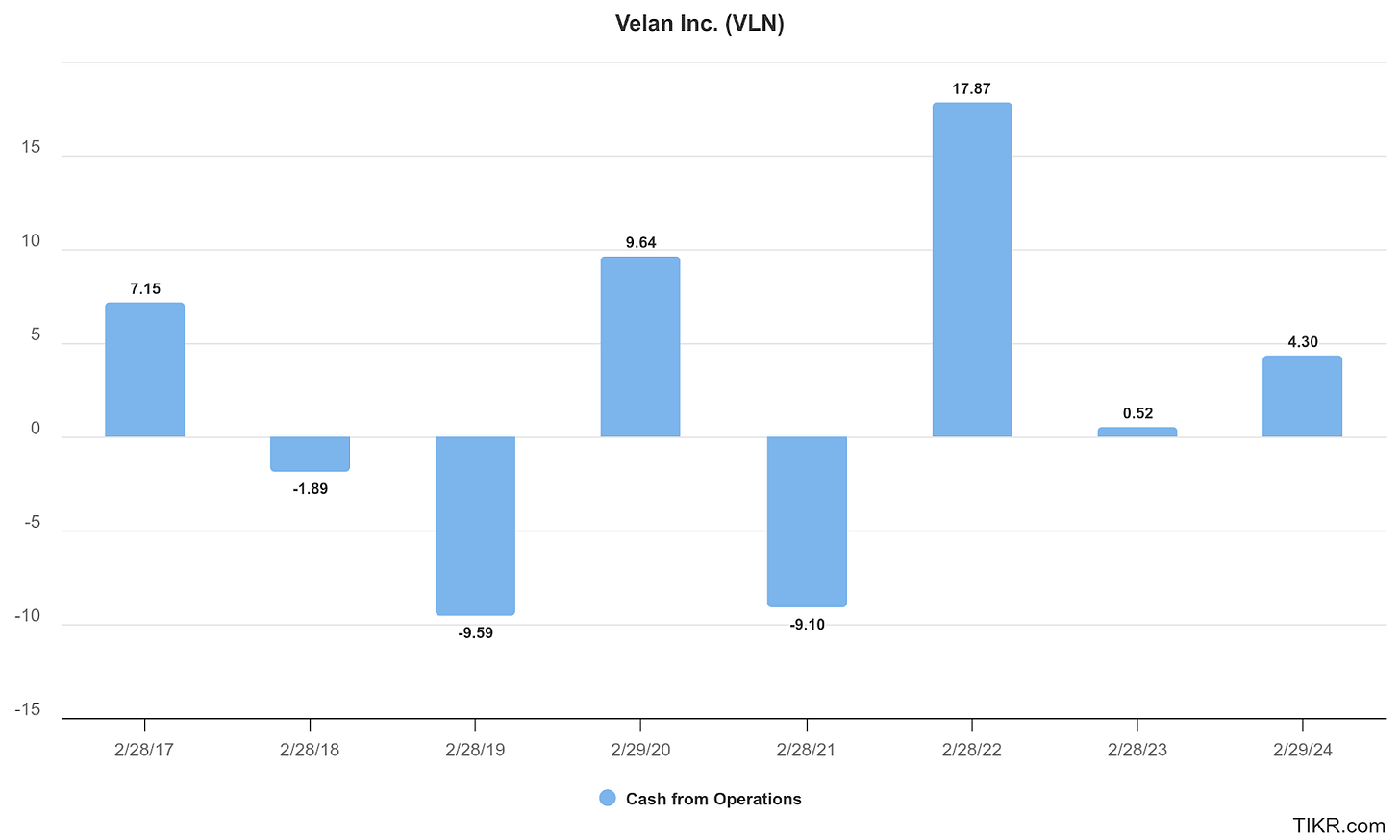

Cash Flow Analysis

Velan generated $4.3 M of cash from operating activities in FY2024, an improvement from essentially break-even $0.5 M in FY2023.

In FY2024, depreciation and amortization ($11.2 M total) and the $10 M asbestos provision (a non-cash charge) added back to cash flow. More importantly, working capital changes contributed cash in FY2024: roughly $9.8 M was released from working capital over the year. This was driven by reductions in inventory (particularly in the fourth quarter) and higher customer deposits. In contrast, FY2023 saw a large working capital build (using $11.6 M cash) as inventory increased and receivables weren’t fully offset by payables.

The swing in working capital was a key factor in the cash flow turnaround. Specifically, inventory levels, which had grown earlier, were drawn down or sold in late FY2024 (inventory change contributed +$4.25 M to cash in FY2024 vs –$14.2 M in FY2023).

Accounts receivable provided a small $2.6 M cash (they declined slightly), and accounts payable increased, providing $8 M cash. This indicates Velan managed its working capital more efficiently.

Overall, operating cash flow has been weak but turning positive, reflecting the company’s low-margin profile but also that a large portion of the recent “losses” were non-cash. Velan’s operations have not burned significant cash outside of working capital swings – even in the worst recent year (FY2023), CFO was roughly neutral, showing that the company did not hemorrhage cash in its downturn.

Free Cash Flow and CapEx: Free cash flow (FCF) was negative $2.54 M in FY2024, but this was a smaller outflow than the –$3.85 M FCF in FY2023.

The improvement is due to higher operating cash and despite higher CapEx. Velan increased its capital expenditures to $6.84 M in 2024 from $4.37 M in 2023.

This spending went into property, plant, and equipment upgrades (e.g. $2.9 M invested in Q4 alone), maintenance capex and select growth projects.

Additionally, around $2.4 M was invested in intangible assets (software, development) over the year. Even with these investments, FCF was close to break-even, showing the company is managing to fund its capex internally.

Depreciation vs. CapEx: Depreciation was higher than capex in recent quarters, which suggests Velan has been under-investing relative to asset depreciation for a couple of years (indeed, net PPE shrank slightly from FY2022 to FY2023 and held steady in FY2024). This could mean the company has some capacity to increase capex if needed, but it also implies they have not been in expansion mode. The positive aspect is that even during restructuring, Velan maintained some capital investment (nearly 2% of sales in FY2024), indicating they may be keeping equipment and systems up to date.

Working capital as a use/source of cash: It’s clear that working capital swings dominate Velan’s short-term cash flow. The big inventory build in FY2023 was a cash drag, whereas in FY2024 the company unwound some of that, helping cash flow. As the backlog is delivered, we should expect working capital (especially inventory and customer advances) to normalize – potentially inventory will convert to cash, but customer deposits might also convert to revenue (reducing that liability). Monitoring FCF after adjusting for these swings provides a sense of earnings quality. In FY2024, if we neutralize the working capital contribution, core FCF would have been more negative, so continued improvement in profitability is needed to sustainably generate positive free cash.

Cash Flow Alignment with Earnings: Velan’s net income and operating cash flow have diverged due to large non-cash charges. For instance, in FY2023 the company reported a $(55.5) M net loss, but operating cash flow was essentially $0.5 M positive. The $56 M asbestos provision in 2023 was an accrued expense that did not use cash in that year (it covers future claim payouts), explaining much of this gap. Similarly, in FY2024 net loss was $(19.8) M while operating cash flow was +$4.3 M.

Depreciation and provisions (totaling over $18 M) made the cash flow much better than the accounting loss. This shows earnings were heavily impacted by non-cash items, and in cash terms the business is closer to breaking even. It’s a positive sign that cash flow from operations has been better than net income – generally indicating no aggressive revenue recognition (if anything, some revenue is collected in advance as deposits) and that accounting charges (like provisions) are not draining cash immediately.

One caveat: actual cash outflows for asbestos claims will occur over time (legal settlements and fees) if they don’t close the transaction with Global Risk Capital. These were ~$6–7 M in FY2024 (as implied by the reduction in the asbestos provision net of the $10 M added). So while the provision was non-cash, there is an ongoing cash cost that will persist until the liability is resolved (which the company aims to do via the divestiture in the coming weeks).

Excluding legacy issues, Velan’s net income and cash flow are more aligned; for example, adjusted EBITDA $17.8 M minus capex $6.8 M roughly equals the $11 M adjusted operating cash before working capital, which is in line with a near-breakeven adjusted net result.

Investing and Financing Cash Flows: In FY2024, cash used in investing activities was $14.1 M. This consisted of the $6.8 M capex and about $5.2 M net purchase of short-term investments (the company moved some cash into short-term deposits/instruments) plus intangible asset additions.

In FY2023, investing activities actually provided $1.8 M net because Velan reduced its short-term investments by $8.3 M (drawing cash back), partially offset by $4.4 M in capex.

These swings in short-term investments suggest the company manages excess cash actively – parking surplus cash in short-term instruments when not immediately needed.

Financing activities in FY2024 used $4.66 M net. The major financing cash flows were: repayment of long-term debt $8.76 M, increase in long-term debt $1.29 M (net debt repayment ~$7.5 M) repayment of lease liabilities $1.90 M and dividends ~$0.49 M. These outflows were partly offset by any short-term bank borrowing changes (for example, Velan had a small bank overdraft of $0.26 M in prior year that was cleared in 2024).

In FY2023, financing used $2.62 M net as the company drew $3.67 M of debt but repaid $4.40 M and paid leases/dividends.

Sources of cash: The primary source of cash has been internal operations (albeit minimal) and customer deposits (which effectively fund working capital). Velan has not relied on external equity or large new debt financing in recent years.

Uses of cash: Primarily, cash has gone to fund working capital (in FY2023), capex, and to reduce debt. The company also reinstated its small dividend, indicating confidence in liquidity. No share buybacks were done (cash was conserved for debt reduction and investment).

Cash Flow Outlook: With the planned removal of asbestos liabilities (which will likely involve a one-time cash outlay of ~$143 M funded by the french asset sale proceeds) Velan’s operating cash flows should improve because it will no longer incur legal payments and provisioning for those claims. In the short term, however, the company’s free cash flow will depend on executing the backlog. If sales ramp up in FY2025 as expected, we may see a temporary working capital usage (to build inventory for deliveries, etc.), but ultimately higher sales should generate more operating cash.

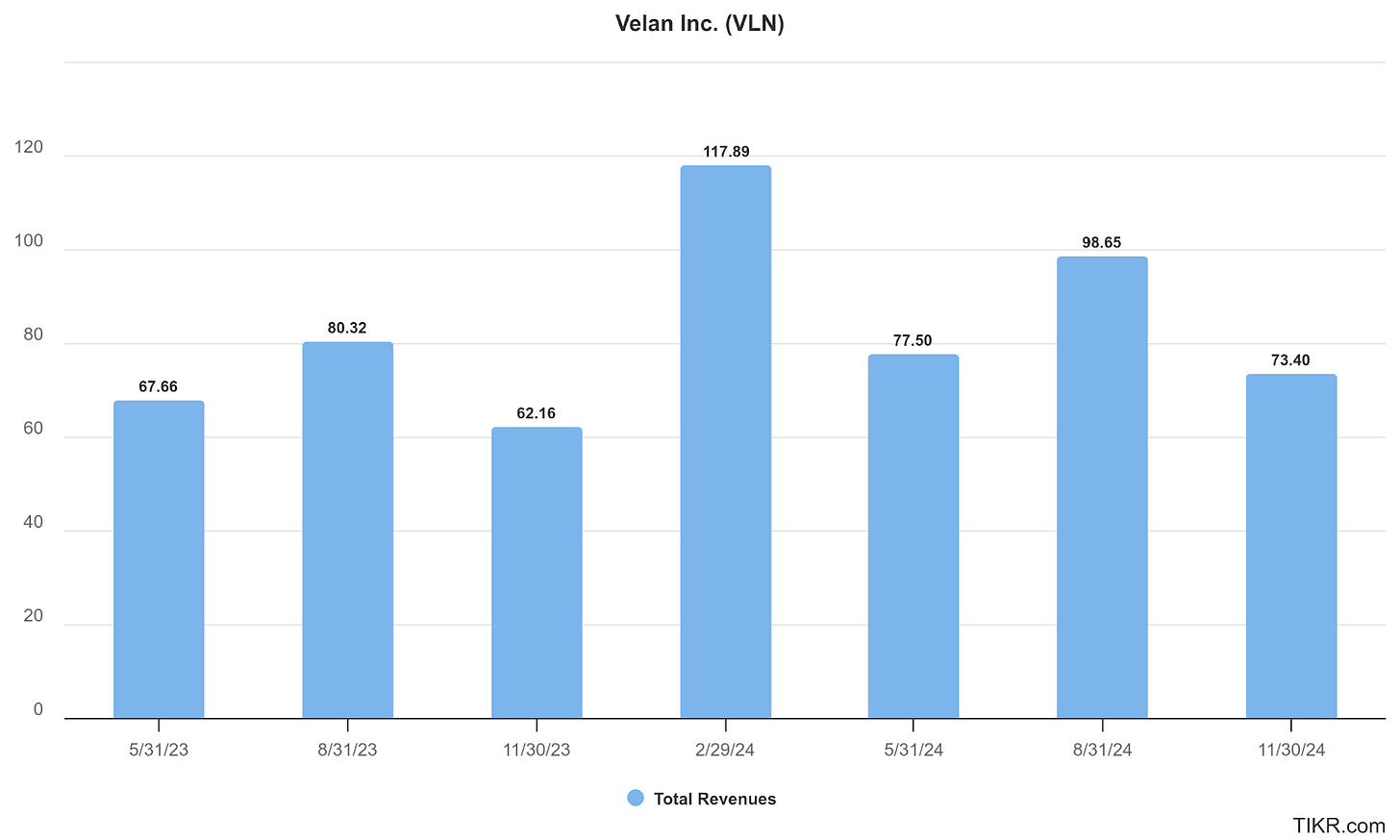

So far we have seen higher YoY numbers but we have yet to see the last quarter of their fiscal year that is usually the strongest one:

The company’s capex needs are not expected to spike; likely they will remain around $5–10 M annually, which can be covered by operating cash if margins normalize.

In summary, Velan’s recent cash flows show a company in restructuring – minimal but positive operating cash, reinvestment in assets, and de-leveraging. There are no alarming cash flow red flags like persistent negative OCF or huge capex commitments beyond means. The misalignment between net income and cash flow is understood (driven by non-cash charges), and aside from that, cash generation has been roughly in line with the low-margin nature of the business.

Post-Deals Closure Pro Forma Financials

Velan is undergoing two major transactions – the sale of its French operations and the divestiture of all asbestos liabilities – which will significantly alter its financial profile.

Below is a breakdown of the pro forma impact:

Revenue and Operations Impact: The sale of the French subsidiaries (Velan S.A.S. “Velan France” and Segault SAS) will remove a substantial portion of Velan’s revenue. In the fiscal year FY2023, France contributed roughly 24–25% of total sales (about $90.8 million of $370.4 million).

Post-sale, Velan’s ongoing revenue base will be smaller – focusing on North America and other regions outside France. Based on this proportion, annual revenues will drop by roughly one-quarter (for example, using FY2024 sales $346.8 million, one might estimate pro forma continuing sales on the order of ~$290 million if the French piece is removed, which goes inline with the $250 million of backlog NTM).

This also means a narrowing of Velan’s scope: the company will no longer directly serve the French nuclear valve market (the buyer, Framatome, will take over that business). However, Velan will continue to operate in the nuclear valve sector outside of France, and management emphasizes that it remains well-positioned in clean energy and nuclear markets globally.

We should note that the French subsidiaries were profitable historically, so divesting them removes a medium earnings contributor.

In the latest quarter before the sale, the French segment showed a loss (due to one-time write-downs ahead of sale), but on a normalized basis those operations had positive margins.

The corporate overhead in Montreal can now be focused solely on the remaining operations, potentially yielding some cost savings. Overall, the continuing business will be leaner and more geographically concentrated, with a focus on North America and other export markets, particularly for nuclear and industrial valves.

Pro Forma Debt and Cash (“Virtually Debt Free”)

A core benefit of these transactions is the expected strengthening of Velan’s balance sheet. Velan is selling the French subsidiaries for a total consideration of US$198.4 million (€192.5 million). This includes a cash purchase price of approximately US$175.2 million plus the buyer’s assumption of a $23.2 million intercompany loan owed to Velan.

In parallel, Velan will divest its asbestos liabilities by selling the affected entity to an affiliate of Global Risk Capital. To facilitate this, Velan will capitalize the entity with $143 million in cash (with Global Risk Capital contributing an additional $7 million).

Velan explicitly stated it plans to fund the asbestos transaction using “available cash and a portion of proceeds from the sale of its French subsidiaries”. After these transactions, Velan expects to be “virtually debt free”.

Here’s the math: by Q3 FY2025 (Nov 30, 2024), total cash on hand was around $35 million. Now, adding roughly $175 million cash inflow from the French assets sale and subtracting the $143 million cash outflow to fund the asbestos vehicle yields a net gain of ~$32 million. This suggests Velan could end up with around $67 million in cash on hand. Management provides an estimate of $65 million cash pro forma probably accounting for transaction costs.

Even if we assume some taxes or transaction costs, that cash is more than enough to fully pay off the ~$27 million of debt. In other words, post-transactions Velan should have no financial debt and a healthy cash reserve of around $38 million (USD).

Management’s description “virtually debt free” will indeed be true – the company will eliminate its bank debt and likely maintain a net cash position. No new debt obligations are expected to arise from these deals; in fact, they are deleveraging events. (The only scenario where new debt would be needed is if the French sale doesn’t close on time – the company noted it would seek alternative financing for the asbestos deal if necessary. But assuming both transactions complete, Velan won’t need to incur new debt.)

Net Cash and Financial Stability: With a debt-free balance sheet and additional cash, Velan’s financial stability will greatly improve. The removal of asbestos liabilities is particularly significant – previously, the $73+ million provision on the balance sheet and potentially much larger future exposure hung over the company. After the divestiture, all asbestos-related obligations will be off Velan’s books (the buyer will assume them and indemnify Velan for all legacy asbestos claims).

This not only wipes out a large long-term liability but also eliminates the ongoing legal expenses and cash outflows that Velan would have incurred to settle claims each year. In exchange, Velan is taking a one-time hit to earnings (a non-cash charge of approximately $67 million was recorded to reflect the transaction), but that was an accounting loss to clean up the balance sheet.

Going forward, the company’s risk profile is lower: fewer contingent liabilities, no debt service burden, and a cash cushion to handle working capital or invest in growth. Liquidity will be strong – even prior to these deals, Velan had access to over $120 million of liquidity (cash + undrawn facilities). Post-deal, liquidity will largely come from cash on hand since the need for debt facilities might be reduced (though the company will likely keep credit lines for flexibility).

Being virtually debt-free also means interest expense will drop to near zero, which will help profitability slightly (interest costs were not huge, but any savings counts given Velan’s thin margins).

In summary, these moves significantly de-risk the balance sheet and put Velan in a more solvent, flexible financial position.

Use of Proceeds & Capital Allocation

The proceeds from the French asset sale are essentially being used to purchase peace of mind by funding the asbestos liability exit. In effect, Velan is swapping one asset (a profitable business in France) for the elimination of a major liability overhang. After paying the $143 million into the asbestos vehicle, any net proceeds remaining will bolster Velan’s cash reserves.

The company has not announced any extraordinary dividends or share buybacks with that cash – instead, management has indicated the goal is to reinvest in growth opportunities and strengthen the business.

With a clean balance sheet, Velan will be able to redirect its cash flow (previously constrained by legal provisions and debt) into areas like product development, capacity expansion, or potential strategic acquisitions. The CFO specifically noted that being debt-free will “allow for greater investments in growth opportunities”.

Shareholders might wonder if Velan will truly maximize the value of the French sale proceeds – for instance, will the company sit on a large cash pile earning minimal interest? Given the stated strategy, it’s more likely they will deploy funds into current operations (possibly expanding in the nuclear valve segment outside France, or automation and clean energy related products). All this, of course, if they are not the target of a new take over attempt.

The balance sheet post-transaction will also be strong enough to support future M&A if Velan finds a compelling target (now that the company is smaller, it might consider buying niche technologies or complementary product lines to grow).