How This Investor Turned an Overlooked Spin-off into a 100% Return

A case study on how to profit from forced selling and structural inefficiencies

Dear Reader: One of the things I like most about Substack is how it brings together like-minded investors, and it’s through this great platform that I had the pleasure of meeting Kristopher Rymer from Safe Harbor Stocks. Today, Kris is sharing a fascinating case study on how to invest in and profit from spin-offs—an article that, most probably, would earn a nod of approval from Joel Greenblatt himself. Dive into his insights on navigating structural arbitrage in spin-off situations, and uncover a fresh perspective on investing that I hope will capture your interest. Enjoy the read. On to Kris!

On May 26, 2023, I watched as Atmus Filtration Technologies ($ATMU) made its debut on the New York Stock Exchange. I was excited to invest in this company as I like the industrials sector, and this company exhibited many good qualities for an investor.

A spin-off from Cummins, Atmus had just completed its first day of trading with an 11% increase, opening at $21.67 and closing at $21.65, well above its IPO price of $19.50.

The market took this as a sign of strength. But I wasn’t buying the shares just yet. I had an idea what was coming next.

Spin-offs often follow a predictable script—a temporary honeymoon period, followed by weeks - or even months - of neglect. One of the reasons? Most Cummins shareholders hadn’t signed up to own Atmus.

"There are plenty of reasons why a company might choose to unload or otherwise separate itself from the fortunes of the business to be spun off. There is really only one reason to pay attention when they do; you can make a pile of money investing in spin-offs." - Joel Greenblatt

Spin-Offs and Structural Arbitrage

Atmus wasn’t struggling. In fact, it was the exact opposite. As Cummins’ former filtration business, it was a high-margin, cash-generating segment with a recurring revenue model. Cummins founded the company internally in 1958 and had grown the company over the preceding 65 years. The parent decided to spin off Atmus to unlock growth and opportunities for both entities.

And yet, after the initial IPO hype settled, the stock languished.

Why? Not because of bad fundamentals. Structural inefficiency was the most likely cause—the kind that has created some of the best spin-off opportunities in market history.

Understanding the Spin-Off Overhang

A spin-off often creates a forced supply/demand imbalance in the market.

Institutional Holders Sell Automatically – Many Cummins investors had no mandate (or permission) to hold a separate filtration company that was now much smaller in size. Their funds were built to own industrial conglomerates, not a newly separated niche filtration business.

Index Funds Were Stuck – Since Atmus wasn’t in major indices at the time, passive funds tracking Cummins had to sell their ATMU shares indiscriminately.

No Analyst Coverage – Institutional research was light. The market didn’t yet have a clear understanding of Atmus’ standalone value proposition. It required digging through the S-1 filing (prospectus) without a guide. Many investors would need to buy blindly.

This meant months of selling pressure. It was never about whether Atmus was a good business—it was simply a case of who wanted to own it.

And the answer, for a long time, was: not many people.

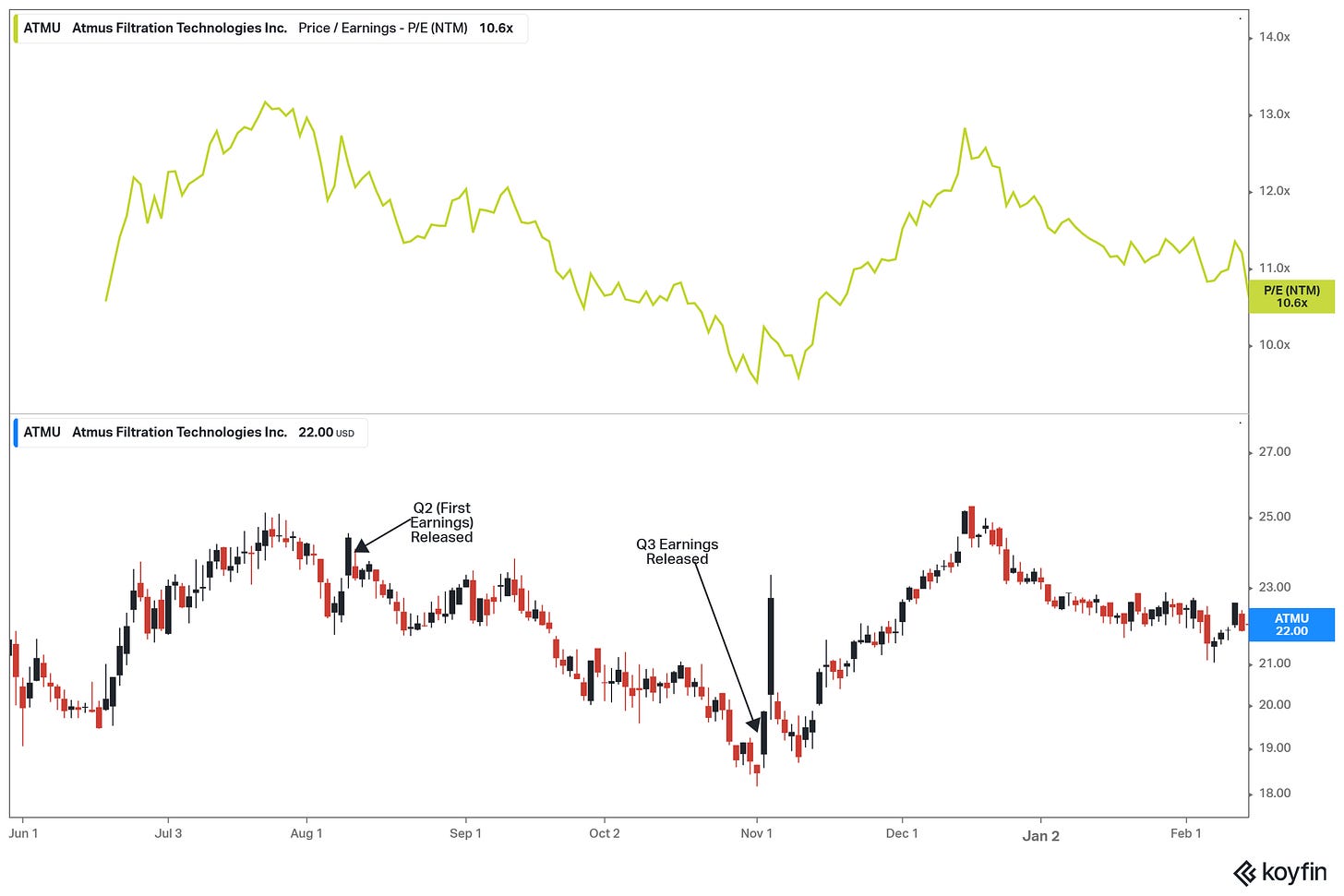

As you can see below, ATMU traded in a range around $20 per share for nearly a year, during which time its P/E ratio declined.

The Familiar Feeling of an Overlooked Opportunity

I’ve spent decades investing in industrial and automotive supply businesses—both as an investor in public markets and as a small business owner. I know firsthand that companies like Atmus, built on recurring revenue from replacement parts, high-margin consumables, and entrenched customer relationships, often don’t get the attention they deserve - at least at first.

Wall Street loves IPOs with flashy tech stories and high-growth disruptors. But steady, cash-generating industrial suppliers? Those are too boring for the spotlight.

And that’s one of the reasons why I paid attention.

Spin-offs have been a goldmine for value investors willing to do the work before the market catches on. I’ve studied enough prospectuses and carve-out financials to recognize the value when a company lacks clear guidance from management or coverage from analysts. It doesn’t mean the value isn’t there—it just means you have to find it yourself.

I had a feeling Atmus would be one of those opportunities.

The Structural Sell-Off (June 2023 - January 2024)

Over the next eight months, Atmus demonstrated why spin-offs are the ultimate test of investor patience:

The Triple Whammy of Forced Selling

Index Fund Purges

S&P 500 trackers holding Cummins automatically dump ATMU shares

Institutional Mandate Conflicts

Part of CMI’s shareholder base holds "industrial conglomerate" mandates

Compliance-driven selling pushes ATMU below $20 by August

Analyst Blackout

Zero coverage at launch (first analyst note appears later in 2023)

Market prices in worst-case scenarios without fundamental justification

"Spinoffs are an interesting place to look because there's a natural constituency of sellers and there's not a natural constituency of buyers." - Seth Klarman

The Orphaned Stock Syndrome

I could imagine in my head the institutional investors already preparing their exit strategies, and there was yet another factor adding fuel to the fire. Cummins retained an 80.5% ownership interest in Atmus shares upon issuance of the IPO.

This meant the stock had a very small float for a $1.8 billion company - there were only about 16 million shares available for public trading.

A relatively small amount of shares outstanding can be an upside catalyst when demand kicks in. However, in this case, a low-float stock1 can also be a detriment when there is a large ownership overhang by an anchor investor.

In this case, Cummins (RemainCo) retained more than 80% of shares and definitely represented this anchor investor. The market would likely remain cautious and hesitant lest Cummins would dump a lot of shares onto the market.

The First Earnings Release Sell-Off

On August 9, 2023, Atmus reported its first quarterly earnings as a stand-alone public company after 65 years inside the Cummins conglomerate.

Margins expanded and revenue increased. Management also provided guidance for FY 2023 of $2.15 EPS implying an 11x forward P/E that day. Perhaps this is a fair multiple for a new SpinCo with a private shareholder overhang and still little to no analyst coverage.

Wells Fargo increased its price target to $26 from $24 the next day and maintained its overweight rating. Nonetheless, the stock proceeded to trade lower by 21% over the subsequent 10 weeks into the end of October.

Shares traded as low as $18.21 on November 1, 2023, a few days before its next (Q3) earnings release.

Opportunity Knocks

I had been down this road many times with other spin-offs. It’s when you’re most uncomfortable in buying a stock that it’s likely the best opportunity - the counterintuitive response a contrarian investor must become comfortable with in order to earn excess return.

In late October 2023 around Halloween, I purchased ATMU stock at $18.75 per share. The stock at the time was:

Trading at a forward P/E ~8.6x

Down 23% from its high

Down 14% from its opening day of the IPO

To be honest, as always, I wondered what I was missing. The fundamentals were strong with high FCF conversion over 90% and gross margins approximately 30%. Now I had to deal with the Q3 earnings release in a few days, but I had conviction in the company and the margin of safety I built in my position by waiting to buy at a discounted price.

As an investor it’s important to be as objective as possible and separate my emotions from my thesis on the company. There will always be uncertainty. We do our best with practice and accumulating experience and instinct. I was rewarded after Q3 earnings with a rebound in the share price seen below:

What About the Cummins Overhang?

An 80%+ ownership stake by a single entity, regardless of it having been the parent company, is a major overhang. This is a characteristic of some spin-offs though the reasons are far too nuanced and convoluted to explain here. Nonetheless, Cummins chose to retain at least an 80% interest in Atmus in this case.

I believed Cummins to be a quality company demonstrating a commitment to value preservation and creation for shareholders of Atmus and itself. Moreover, I was able to buy the shares with a margin of safety as described above. The company also exhibited some promising characteristics which I knew firsthand based on my own distribution business experience:

High percentage of recurring aftermarket revenue

Captive pricing of OEM contracts with price escalators

Plans to expand margins through SKU optimization, labor arbitrage and supplier consolidation

Large installed base with higher margin upselling opportunities

Now I just needed to practice patience and exercise emotional discipline.

Here’s an article I wrote on emotional discipline if you would like to learn more:

The Catalyst: Cummins Sets Up the Breakout

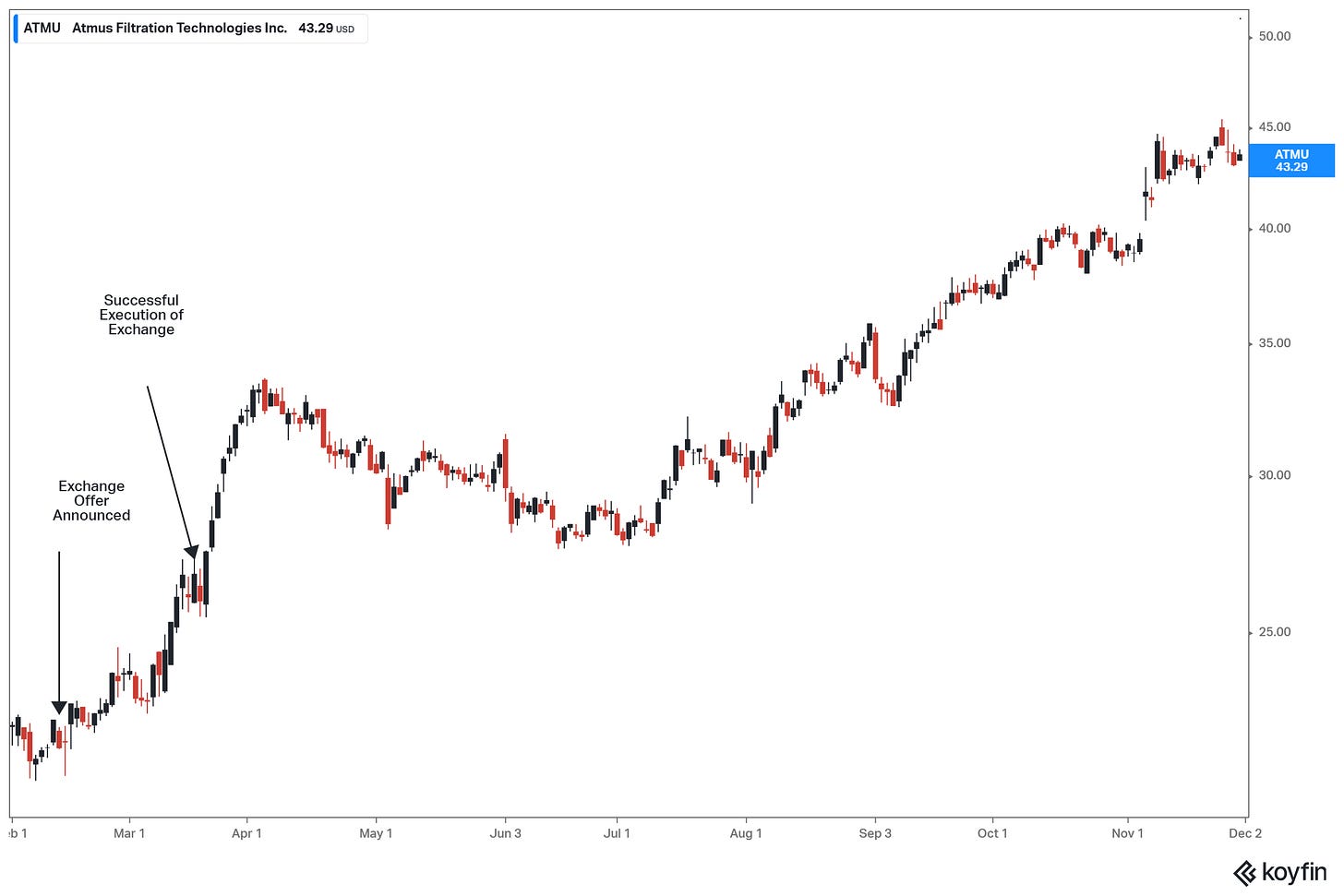

Fast forward to February 14, 2024—the day everything changed. Coincidentally it occurred on Valentine’s Day.

Cummins announced an exchange offer to divest its remaining 80.5% stake in Atmus. The deal gave Cummins shareholders a 7% discount to swap their CMI shares for ATMU.

This signaled two things:

The overhang was about to clear—once Cummins completed this exchange, it would no longer be dumping shares into the market.

Atmus would finally be in the hands of real investors—not just those who inherited it through the spin-off.

This wasn’t speculation—it was exactly what past spin-offs had shown. Studies from McConnell & Ovtchinnikov (2004) found that once the parent company fully divests, the spun-off stock begins to trade based on its true fundamentals rather than forced selling pressure.

The Exchange Offer Endgame

After Cummins announced the 7% discounted swap, a week later the stock barely moved rising 1.8% to $22.47 from $22.06 just prior to the announcement. Most investors would wait and wonder.

I acted and doubled my position, now holding an average cost basis of $20.50 per share. The opportunity was NOT the 7% discount. There was some arbitrage and incentive there by Cummins to encourage a full subscription of the exchange, of course. The myopic short-term traders would exchange their CMI shares and quickly sell ATMU stock for a small potential gain.

The real alpha here was the fact that this exchange would most likely clear our share overhang held by Cummins - paving the way for the stock to trade on its own fundamentals rather than an orphaned SpinCo.

There would be other positives post-separation, such as potential inclusion in certain S&P indices with a fully independent company and better appeal to institutional investors.

Awaiting Participation

Even in early March 2024, nearly a month after the exchange announcement, the stock was only trading around $24. The market was awaiting the results of the participation in the exchange offer.

Often, I don’t see price discovery in such a situation until there is more concrete evidence, in this case of CMI shareholders taking the exchange. Wall Street does not like relative uncertainty. I believed Cummins constructed a good balance with the 7% discount and was confident the exchange would be well subscribed.

On March 18th, Atmus announced that Cummins successfully executed the entire exchange offer removing its ownership of the company. Over the next two weeks the stock rose more than 23% to over $33 per share. That’s about a 60% rise from my cost basis and 81% from the lows.

Atmus continued to trade higher and today trades at a 16x forward earnings multiple. In addition, the company now expects FY 2025 EPS of $2.50 per share. The share price benefitted from EPS growth and price appreciation from a re-rating of the stock after the Cummins exchange.

Atmus later was added to S&P indices and institutional ownership surged. I eventually sold at a 17x PE in the high teens during November 2024. I earned a 2x in approximately one year - from a boring industrial stock.

I may re-enter on a healthy correction. Sometimes I do hold these companies longer-term after these situations play out, but sometimes I move capital onto other value plays. I can’t shake my passion for researching the next opportunity.

The Playbook for Spin-Off Investors

First, it is important to understand that many spin-offs underperform - badly. Identifying the profitable ones requires experience and the ability to understand the prospectus - at a minimum. That said, spin-offs can present very attractive potential returns if you are patient. Deal flow can vary due to capital markets and the economic environment, but on average I see at least one or two worthwhile candidates per year.

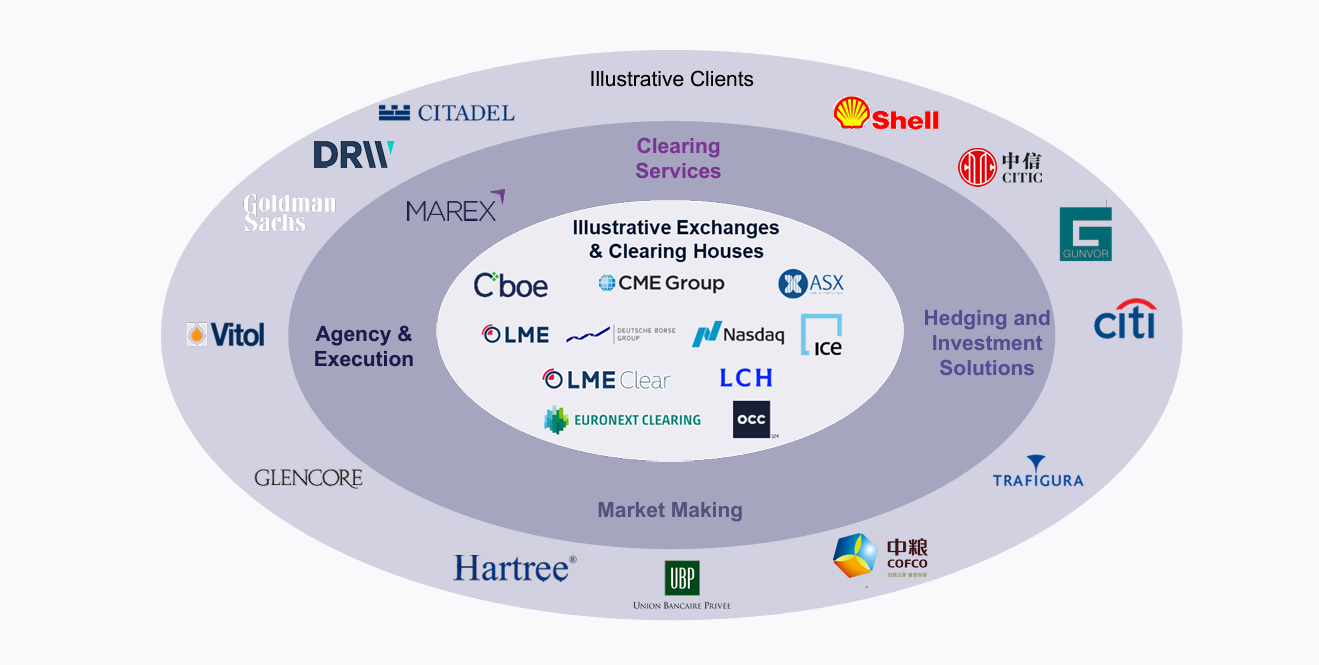

Another close cousin to the spin-off, in my opinion, is the PE-backed IPO. These are similar yet very different, and I plan to publish another article on this type in the near future. One great example is the Marex Group IPO ($MRX) in Spring 2024. Below is my write-up on that one.

Now, let’s dive into some best practices for identifying good spin-off opportunities.

Setup for Success: The best spins are those where RemainCo sets up SpinCo for success through manageable debt and a reasonable path through transition.

Track the Liquidity Horizon: Each spin-off is its own animal with different registration statements, ownership structures, governance provisions and lock-up windows.

Insider Participation: It’s a positive sign when insiders retain significant ownership. Sometimes a good executive from the parent may take over as CEO of SpinCo because it sees a great opportunity to make that smaller company larger.

Good Reasons for Spins: It’s nice to see a clear reason for the spin from parent’s management. Often good opportunities come from divesting a non-core business or a balance sheet recapitalization of the parent company.

Quality over Quantity: As mentioned earlier, there can be many bad spins. Be patient and focus on a few good ones.

Know the company: Whether you rely on yourself or another’s advice it is important to have an extensive understanding of both the RemainCo and SpinCo through analysis of each company and the registration statement (S-1 or Form 10).

Time is On Your Side: There is a temptation to feel you will miss out post-IPO. Don’t chase anything. There is plenty of time to review the filings in part due to the inherent structural imbalance.

Study the Research: At the end of this article is a list of research papers which you can study to learn more about spin-offs.

I hope you enjoyed this article. If you are interested and want to learn more, then you can always email me at kris@safeharborstocks.com or visit the newsletter below:

Research Papers and Resources:

Corporate Governance in Spinoffs: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=637001

“You Can Be a Stock Market Genuis” (Greenblatt)

Predictability of Long-Term Spinoff Returns (McConnell 2004)

Mastering the Good Breakup (Bain)

Low-float stock: when the quantity of shares available for trading on the public market (the “float”) is a low percentage of the total value (market cap) of company shares outstanding.

Really useful article, thanks!

Interesting article! Thanks for the advice at the end.