How This Micro-Cap Stock Soared 37x in 2024 And A Long-Term Investor’s Playbook for the Earnings Season

Overreactions, underreactions, and long-term opportunities

Dear Reader: Every few months, we investors, as owners of small pieces of businesses, receive updates on the performance of the companies we own—it’s earnings season. Sometimes there are overreactions, sometimes underreactions, and sometimes the stock price does exactly the opposite of what one might expect based on the results provided. Why is this? In this article, I want to explore why these reactions often seem exaggerated or puzzling, with some interesting examples along the way. Let’s dive in!

Human psychology plays a powerful role in earnings season. Instead of instantly and rationally pricing in new information, investors often let emotions take the wheel. This leads to two seemingly opposite phenomena that frequently go hand in hand: overreactions and underreactions.

An investor overreaction is an emotional surge that pushes a stock far above or below its fair value in response to news. Think of a company reporting slightly disappointing earnings and investors panic-selling so intensely that the stock becomes oversold, only to bounce back later.

On the other hand, an underreaction is a muted move when a stronger response was warranted – investors anchor to prior beliefs and only slowly adjust to the new information. These are my favourite situations.

In these cases, a stock might not rise enough on great news, and then keeps climbing for days or weeks as the market gradually “catches up” to reality.

These reaction patterns are not random; they’re systematic features of investor behavior.

Psychologically, we’re wired to overweight dramatic, attention-grabbing news (fueling overreactions) and underweight information that conflicts with our prior views (leading to underreactions through anchoring or confirmation bias).

During earnings season – when a flood of data and surprises hits the market at once – these biases can be especially noticeable. You know the consequence, the result is a pendulum of sentiment swinging too far one moment and too little the next.

FOMO, Panic, and the Price Tag: The Unseen Forces Behind Earnings Surprises

When a company’s earnings news hits like a bolt from the blue, the immediate price reaction can be extreme.

Overreaction often manifests as an overshoot: investors bid the stock up or down far beyond what the new fundamentals justify, driven by either excitement or panic! There are a myriad of behavioural biases that affect market participants – they get swept up by fear and greed, as well as by herd behavior.

In the frenzy of an earnings surprise, greed can morph into FOMO (fear of missing out) on good news, while fear can amplify a rush for the exits on bad news. Think about it, all of us have been there.

In practice, stocks often run up in anticipation of strong earnings, only to fall after the actual report, even if the news is positive. This isn’t mere folklore; it reflects investors’ tendency to overshoot expectations.

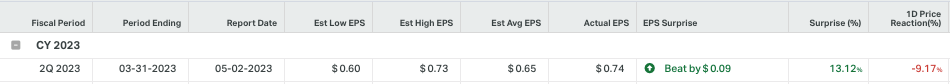

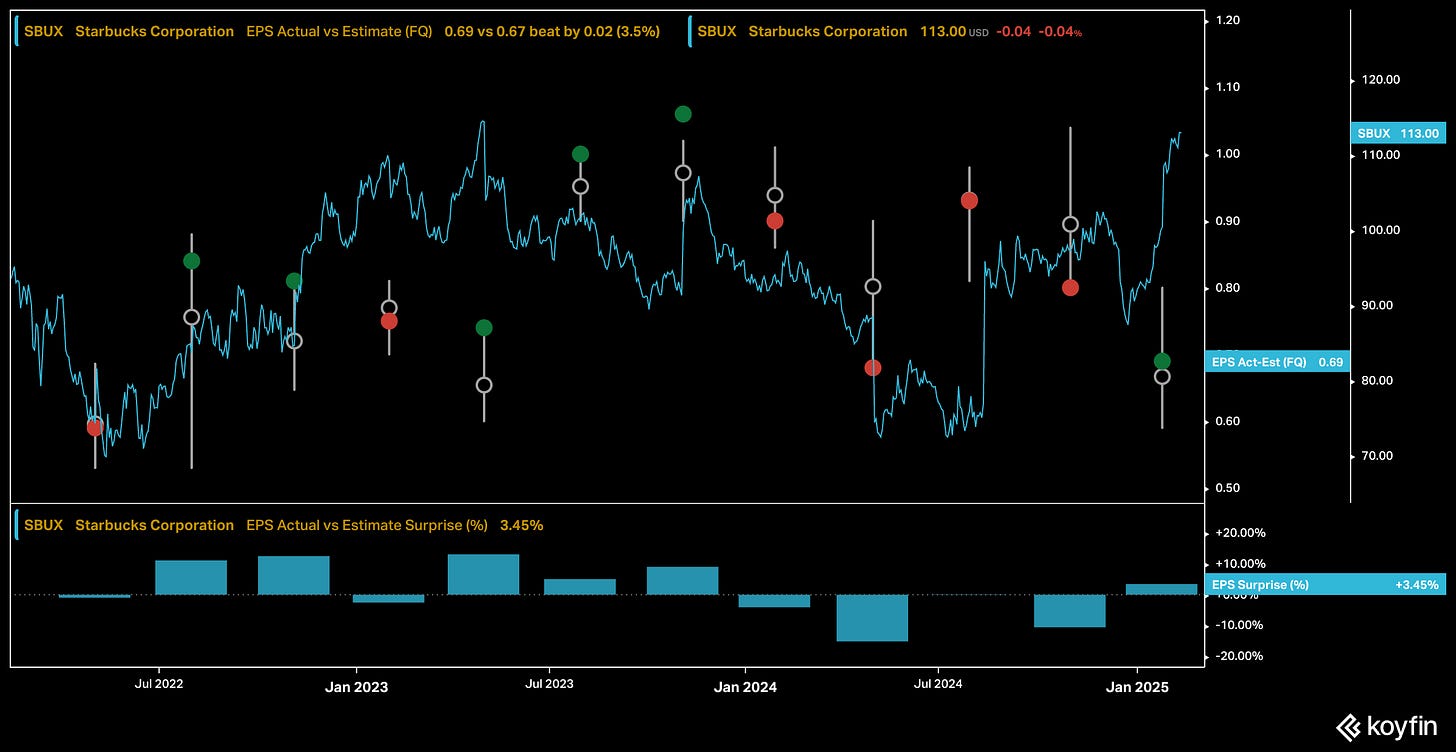

For example, let’s look at a case where analysts expected Starbucks to deliver solid growth in an earnings report. In Q2 2023, Starbucks announced earnings and revenue that beat estimates by ~13%, with an 11% jump in same-store sales – objectively great results. Yet, instead of rallying, the stock fell about 9% in the following hours.

Why?

Because investors had hoped for even more – specifically, an upward revision of future guidance – and when management simply reiterated its outlook, short-term holders sold the news.

In essence, the market overreacted to what it perceived as a letdown relative to lofty expectations, illustrating that even a “glowing” earnings report can trigger a selloff if the whisper numbers were higher.

A company might beat official forecasts but still see its stock drop if investors were expecting bigger numbers; a smaller beat can feel like a miss when the bar was set too high.

Overreactions aren’t limited to selling on good news – they also appear as overly euphoric buying on relief that things weren’t as bad as feared.

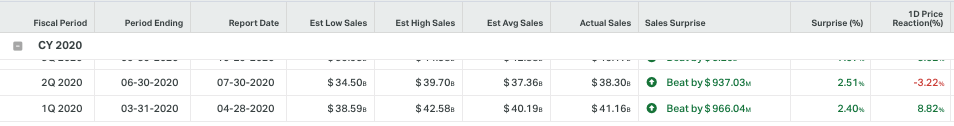

An interesting example occurred with Alphabet (Google) in April 2020. The company slightly missed its earnings target amid pandemic uncertainty, but reported better-than-expected revenue.

This relief sent Alphabet’s stock jumping nearly 8% the next day. One could argue the market overreacted to one bright spot (revenue) while overlooking larger worries on the horizon.

The market seemed to have priced in too much optimism too quickly, given the likely challenges in the next quarter . In other words, exuberance took the stock above a level justified by fundamentals in the near term.

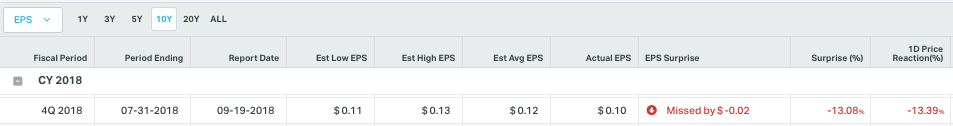

Sometimes, overreactions are glaring when viewed with a bit of hindsight.

In late 2018, shares of auto-salvage company Copart (CPRT) plunged over 13% in a day after a quarterly earnings miss.

The company’s long-term prospects hadn’t deteriorated by anywhere near 13% in a single quarter – the drop was driven by knee-jerk fear.

A value-focused fund1, sensing the market had thrown out the baby with the bathwater, swooped in to buy, calling the sell-off an “overreaction” and a chance to pick up a great business at a discount. Sure enough, Copart’s stock recovered as the initial panic subsided and investors recognized the underlying strength of the company.

So, What Drives Such Overreactions?

Beyond emotions, market structure can play a role.

In the first minutes of an earnings release, algorithmic traders and fast-reacting investors can trigger a cascade – for instance, automatic sell orders beget more selling, in a feedback loop divorced from nuanced analysis.

Additionally, when a stock has been a “market darling” with a rich valuation, even a slight hiccup can prompt an outsized fall as investors quickly rethink growth assumptions (think NVDA just recently).

Likewise, you can see the opposite in heavily shorted stocks: a positive surprise sparks rapid short-covering that sends the price rocketing beyond a sensible level.

Ironically, even the attempts to correct mispricings can overshoot; financial research suggests that when too many arbitrageurs pile onto a known opportunity (like betting on a post-earnings drift), their collective action can overshoot the target, effectively destabilizing the stock price. In other words, if everyone tries to exploit an anticipated underreaction, it might flip into an overreaction as excess capital pushes the price beyond fundamental value2.

The key thing to keep in mind is that overreactions tend to self-correct. A stock that is “excessively sold off” on earnings often finds a bottom and rebounds once rational analysis returns.

In the same way, an “overbought” pop can flatten out or retrace once the initial hype fades.

The Slow Wake-Up Call: Capturing Value in Earnings Underreaction

Not every earnings move is explosive.

Sometimes the market’s response is strangely subdued given the significance of the news. This is where underreaction comes into play – and it’s a goldmine of insight for the patient investor, that is the reason I like this situations.

Underreaction in the earnings context means the stock’s initial jump or drop doesn’t fully reflect the implications of the earnings news.

The remaining impact then unfolds slowly, as investors process the information over time and adjust their positions gradually. This phenomenon is so common and so well studied that it has a name in academic finance: Post-Earnings-Announcement Drift (PEAD) – the tendency for a stock to drift in the direction of an earnings surprise for days or even months after the report.

In simple terms, a company that delivers a positive surprise will often see its shares continue to trend upward in the weeks following the announcement (and negative surprise stocks continue to trend downward), beyond the immediate one-day reaction.

PEAD was first documented over 50 years ago3 and apparently it remains one of the most persistent market anomalies. It directly contradicts the idea that markets instantly price in all information.

Why does it happen?

Psychology offers some answers. Investors may anchor to prior expectations – if a company wildly beats earnings forecasts, many won’t immediately upgrade their mental models; instead, they temper their reaction (“maybe it was a one-off good quarter”) and only later, as more data or analyst upgrades roll in, do they fully bid the price up. Below I’ll share an example of precisely this phenomenon.

Likewise, investors may show confirmation bias in reverse– they initially underweight news that doesn’t fit their prior view of a company. The result is, again, a delayed reaction: the stock moves gradually as believers and skeptics alike come around to the new reality.

In other words, the initial move is only part of the story; the rest of the adjustment plays out as a slow burn.

There are plenty of real-world scenarios that illustrate underreaction.

Often, they’re less dramatic on day one, which is exactly the point – the drama comes in the following weeks.

But there’s more. Extraneous events can also play a part in the underreaction.

Extraneous Events and Underreaction to Earnings News

Imagine a mid-cap tech firm reports earnings and blows past estimates, but on a day when 50 other companies also announce results. The stock might rise say 3% on the news – a modest “beat” reaction. However, in the subsequent month, as more investors dissect the stellar results, the stock quietly climbs another 20%.

This kind of scenario is common enough that statistically, stocks with the biggest earnings surprises have been shown to significantly outperform in the months after the announcement.

One study4 found that on days with lots of competing news (many announcements the same day), underreaction is magnified.

What happens then?

If a company’s great earnings report didn’t make a big splash initially (perhaps because many were looking elsewhere), there may be more upside to come as the information slowly percolates through the market.

This is a fascinating finding: on days when many headline names announce earnings along with some mid or small caps, earnings surprises can be muted, and it is worth paying attention to opportunities.

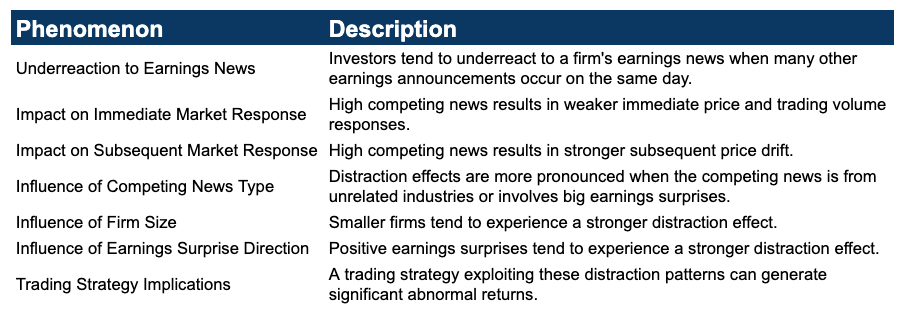

The paper is called: “Driven to Distraction: Extraneous Events and Underreaction to Earnings News”.5

"Apparently, a trading strategy exploiting these distraction patterns can generate significant abnormal returns. Since the paper is a little dated, these effects are probably already arbitraged away. Nevertheless, I wouldn’t be surprised if we can still observe this effect in small caps outside the US.

Below, a table with this paper’s main findings:

https://docs.google.com/spreadsheets/d/1ao3LDfIILUFJWJXQr0y0m6TmEhEkkMXw7-dV89znTH4/edit?usp=sharing

Another interesting pattern is that underreaction tends to be stronger in less followed stocks.

Smaller firms or those with few analysts covering them often experience more gradual price adjustments, simply because fewer eyes and algorithms are on the case at the moment of the announcement.

Research has noted that post-earnings drift is stronger for smaller firms6, presumably because large-cap names instantly grab the attention of dozens of analysts and millions of traders, while a small-cap’s blowout quarter might go relatively under the radar initially.

For the attentive investor, this means the inefficiencies are greater outside the spotlight – a savvy investor can build a position in a small company in the days after an excellent earnings report, before the rest of the market truly wakes up to the news, and this is with the confirmed information provided by the company!

In practice, underreaction is the friend of momentum investors (who ride the drift) but also of value investors who might use it as confirmation. For example, if you own a stock that you thought was undervalued, and it delivers a terrific quarter, an initial pop of +5% might only be a partial victory – you might hold or even add to the position, expecting that as the market appreciates the company’s improved prospects, the stock could continue to rise.

The underreaction phenomenon essentially gives long-term investors a second chance to act on information after the headline day has passed. It’s a window where the news is out but not fully digested.

Let’s see an example with one of the micro-cap stars from 2024.

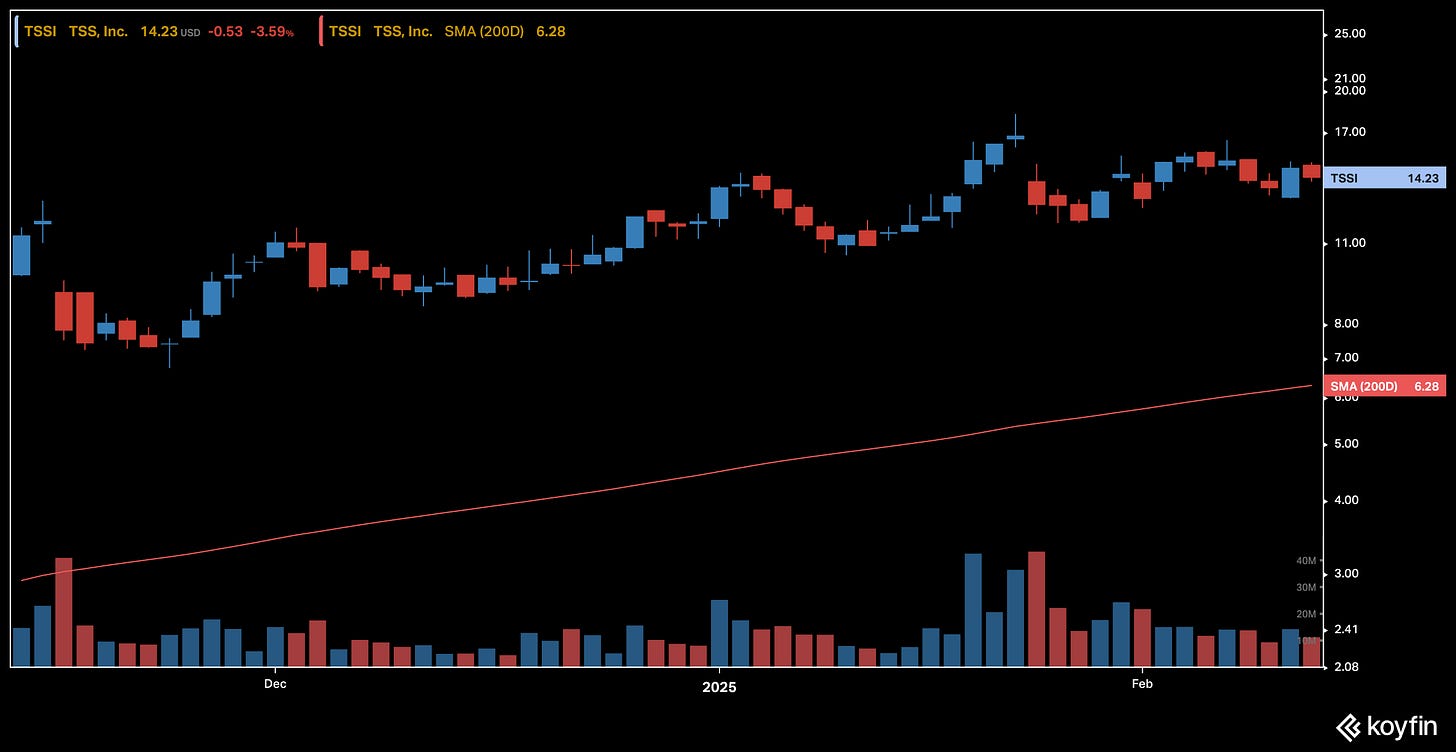

TSS, Inc. (TSSI) – A Micro-Cap Tech Company with Big Earnings, Slowly Discovered That Did a 37x in 2024

That’s right, 37x in 2024. It would be 45x if you had held from January 2024 to February 2025.

So, what happened here?

TSS, Inc., a tiny data-center/AI infrastructure provider, announced Q2 net income up +345% year-over-year with revenue $12.2M and gross profit +41%. Although Q2 sales dipped slightly from a year prior, higher-margin integration projects drove much better profit.

Management team also projected a strong second half of 2024 on booming demand for AI-related server racks, you just had to read the earnings transcript! (Subsequently, in mid-November, TSS’s Q3 report showed revenues exploding 689% YoY to $70M as those projects ramped).

TSSI’s stock, which trades over-the-counter with little analyst coverage, did not immediately soar on the Q2 news as much as it should have with the avalanche of positive news they reported with the tidal wave of AI on their backs. With virtually no major media outlet following, the market kind of underreacted, up +18% on the news.

Even after the astounding Q3 revenue growth (and a swing to big profits), the stock’s move was not instant; it took time for broader market participants to catch on. It even went down shortly after Q3 announcements.

Over the latter half of 2024, TSSI became one of the top-performing stocks in the entire market, rising several thousand percent. The rally really gained steam after the Q3 results confirmed management’s bullish outlook.

By year-end 2024, the stock was up roughly 3,700% for the year. In other words, what began as a quiet post-earnings drift turned into a massive re-rating once investors recognized the transformational growth underway.

In August, TSS Inc. was a classic case of a “hidden gem” – a micro-cap ($<100M market cap) with no analyst coverage. Many investors simply hadn’t heard of it.

Yet the company was tapping into a huge trend (AI and data center build-outs) and showing record results. Its integrated platform for data center tech was clearly succeeding, but trading OTC meant low liquidity and visibility.

Fundamentally, TSS had shifted to higher-margin offerings and expanded capacity right as demand surged – a recipe for big earnings beats that should have drawn attention sooner.

The delayed rally was fueled by continuing great news and eventual investor attention. The Q3 (September quarter) earnings in November were impossible to ignore: revenue up nearly 7× year-on-year. That confirmed the bullish thesis and brought in new buyers. Financial newsletters and forums started to mention TSSI as an “undiscovered AI play,” and as the stock kept making new highs, momentum traders jumped in.

In short, fundamental outperformance in consecutive quarters eventually forced the market to revalue TSS Inc., turning an initially underreacting stock into a huge winner.

Capitalizing on the Aftermath of Earnings Overreactions

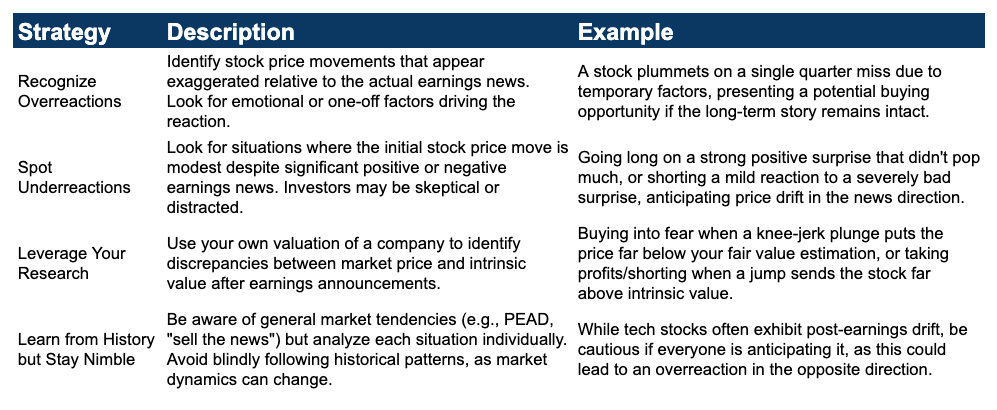

For the experienced investor, the goal is to separate signal from noise – to discern when a price move is an emotional overshoot versus a genuine re-rating of a company’s prospects. The patterns of overreaction and underreaction I wrote about above, offer a sort of roadmap. They reveal that, more often than not, the market’s first move isn’t the final word. And that is where long-term, value-driven investors can capitalize.

I read somewhere that crowds tend to “overprice ‘hot’ stocks and underestimate the earnings of distressed stocks.” This dynamic creates steep falls among the former and big rebounds in the latter, “leaving room for the contrarian investor to choose underpriced stocks.”

In essence, patience and discipline during earnings season can allow one to pick up bargains or unload overhyped names by doing the opposite of the panicky herd.

For those taking the long view, here are a few actionable takeaways from earnings season psychology:

Conclusion: Selling Hype, Buying Value

By understanding the psychological patterns at play, investors can approach earnings season as a period of opportunity rather than anxiety.

We’ve seen that investor reactions often swing like a pendulum – overshooting on emotion-charged news and undershooting when processing of information is slow. These swings create misspricings: moments when a stock’s price disconnects from its longer-term value. For the prepared investor focused on the long game, such moments are precisely when value can be captured.

Earnings season will always spur volatility – that’s the nature of the beast. But as we’ve discussed, within that volatility lies a predictable psychology. By studying patterns of past earnings reactions and recognizing the signs of investor over-enthusiasm or undue pessimism, you can position yourself not as the panicked seller or euphoric buyer, but as the calculated opportunist who buys value and sells hype.

You can read their letter where they explain their investment in Copart here: https://ycginvestments.com/2018-q3-investment-letter/

https://quantpedia.com/too-much-arbitrage-contributes-to-overreaction-in-post-earnings-announcement-dr

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6(2), 159–178. https://doi.org/10.2307/2490232

Hirshleifer, D., Lim, S. S., & Teoh, S. H. (2009). Driven to distraction: Extraneous events and underreaction to earnings news. The Journal of Finance, 64(5), 2289–2325. https://bpb-us-e2.wpmucdn.com/sites.uci.edu/dist/c/362/files/2011/02/Driven-to-Distraction-Extraneous-Events-and-Underreaction-to-Earnings-News.pdf#:~:text=match%20at%20L845%20greater%20underreaction,66

Hirshleifer, D., Lim, S. S., & Teoh, S. H. (2009). Driven to distraction: Extraneous events and underreaction to earnings news. The Journal of Finance, 64(5), 2289–2325. https://bpb-us-e2.wpmucdn.com/sites.uci.edu/dist/c/362/files/2011/02/Driven-to-Distraction-Extraneous-Events-and-Underreaction-to-Earnings-News.pdf#:~:text=match%20at%20L845%20greater%20underreaction,66

Hirshleifer, D., Lim, S. S., & Teoh, S. H. (2009). Driven to distraction: Extraneous events and underreaction to earnings news. The Journal of Finance, 64(5), 2289–2325. https://bpb-us-e2.wpmucdn.com/sites.uci.edu/dist/c/362/files/2011/02/Driven-to-Distraction-Extraneous-Events-and-Underreaction-to-Earnings-News.pdf#:~:text=match%20at%20L845%20greater%20underreaction,66

Me gustó mucho el articulo! Siempre se aprende algo todos los dias. Enhorabuena!