Stealth Monopolies: I Looked For Hidden Giants Dominating Niche Markets And This Is What I Found

Identifying under-the-radar companies with monopoly-like dominance in niche markets

Dear Reader: There’s a type of company I love to own—one that quietly dominates a narrow market niche without attracting much public attention, yet builds a durable competitive advantage through high market share, strong pricing power, and customer lock-in. These companies generate consistent, robust profits. They are called “stealth monopolies.” Let’s explore some examples and how to identify them!

Some companies are just special. They quietly corner a narrow market – be it a specialized product or a behind-the-scenes service – and build monopoly-like power long before the market realizes. These are the stealth monopolies, the under-the-radar businesses that own their niche.

Their dominance means they face little competition, allowing them to set prices, reap high margins, and grow steadily.

Stealth monopolies represent unique investment opportunities because they combine the resilience of a wide-moat business with the pricing inefficiencies of an under-followed stock.

In other words, they deliver sustainable profits protected by high barriers to entry, but their stories aren’t populating any X threads or Reddit forums – just yet.

Once their monopoly-like business becomes obvious, such stocks can revalue upward very, very fast. The key is recognizing them before the crowd does, and there’s lie the difficulty.

Beyond the Screener: The Markers of Hidden Champions

Ok, so how can we identify these hidden champions?

In practice, identifying a stealth monopoly early means digging into not so followed corners of the market. For sure, we are not going to find these companies, early at least, using a screener.

Some investors might comb through industry trade publications, you can attend niche conferences, micro-cap conferences (like the fine one organized by

), or study supply chains to find out who holds the “commanding heights” of a small sector.Now, what should we be looking for? There are some common characteristics that set them apart:

Dominant Market Share: They often hold 50%+, or even near-100%, of a narrow market. In other words, they are the market in their niche. This could be a global share (like a specialized equipment maker with 90% market share) or a regional/sector share. Investors should look for evidence of outsized market share in industry reports or company filings. For example, ASML Holding – an once-obscure Dutch tech firm – now controls ~90% of the market for advanced EUV lithography machines used in chipmaking, effectively locking in its position as the sole supplier of this critical technology. Yes, I know, that one is not small not unknown but bear with me.

Pricing Power (High Margins): With little or no competition, a stealth monopoly can raise prices or maintain premium pricing without losing business. This usually shows up in fat gross and operating margins. If you see a company consistently posting margins well above industry averages, it’s a clue that customers have limited alternatives. Stealth monopolies aren’t in a race to the bottom on price; they’re often in a position to dictate terms.

High Switching Costs: One hallmark of these companies is that their customers are effectively “locked in.” Whether due to technical integration, long-term contracts, or the sheer hassle and risk of switching to a different provider, clients stick around. Retention rates tend to be sky-high. Verisign, for example, enjoys renewal rates in the 70–80% range for its domain customers, because established businesses won’t risk changing their website’s address.

Network Effects: Some stealth monopolies benefit from the network effect, meaning their product or service becomes more valuable as more people use it. This creates a self-reinforcing dominance. In niche B2B markets, network effects might appear as an industry platform that everyone has to be on because everyone else is already there (I’m thinking of specialized marketplaces, Xometry may be? or software platforms in certain industries).

Regulatory or IP Barriers: Some companies achieve monopoly-like status because rules, licenses, or patents keep competitors out. They might hold exclusive government contracts or permits (effectively a legal monopoly), or they own intellectual property that others can’t replicate.

No, I’m not going to recite all the moat sources as outlined by Pat Dorsey. You can read his wonderful book1 to learn more about them. I just wanted to provide some general telltale signs that I see in companies emerging as stealth monopolies.

Another interesting characteristic that helps solidify the dominant power of these types of companies is that their product, while being a small part of their clients' budgets, plays a critical role in operations. I believe this increases the switching costs, as clients won’t risk changing suppliers to slightly improve their margins by just a few basis points, potentially jeopardizing the entire production line.

Ok, so now which are some examples of these holy grail investments? Let’s see.

Can You Spot a Stealth Monopoly? Let’s Review Some Real World Examples

Nothing brings the concept to life better than real-world examples. Here are a few companies that exemplified stealth monopoly traits before becoming widely known (I’ll provide a list of more obscure examples after):

Broadridge Financial Solutions – The Proxy Vote Powerhouse

Hardly a secret anymore and spun off from ADP in 2007, Broadridge operates behind the scenes of Wall Street, handling proxy voting and shareholder communications for publicly traded companies. For years, it had what can only be described as a quiet monopoly in this niche. By 2019, Broadridge was handling over 90% of all proxy votes for U.S. public companies and mutual funds. Its closest competition held only single-digit share. Broadridge is an example of how a company that dominates a small, critical function can deliver outsized value – its stock has compounded nicely as its monopoly became common knowledge.

OTC Markets Group – The Undisputed Over-the-Counter Leader

While most people fixate on the NYSE or Nasdaq, OTCM quietly rules America’s “other” stock market—the over-the-counter space. Its trio of OTCQX, OTCQB, and Pink markets collectively hosts over 12,000 securities, including countless foreign ADRs seeking a cheaper path to U.S. trading. Like Broadridge before it, OTCM has mastered being critical but invisible. It quietly collects fees for listing and market data, with few realistic alternatives for small-cap or international issuers looking to tap U.S. investors.

Invisio – The Covert Comms Connoisseur

If you’ve never heard of Invisio AB (IVSO), that’s perfectly by design. This Swedish manufacturer of advanced tactical communication headsets has carved out a global leadership position in a niche few are even aware of: supplying elite military and law enforcement units with specialized in-ear systems. These headsets both protect hearing and enable crystal-clear communications, even under battlefield conditions. Thanks to lengthy procurement cycles, steep regulatory hurdles, and patented technology, Invisio faces only a handful of real competitors, making it the go-to provider for many NATO militaries. Again, not a cheap company anymore but definitely helps to understand the concept: a hidden leader dominating a specialized, high-barrier segment.

These examples scratch the surface – there are many more. What they all have in common is a focus on a particular niche and the relentless build-up of advantages in that niche until they effectively own it. In many cases, they started under the radar and ended up as indispensable linchpins of their industries.

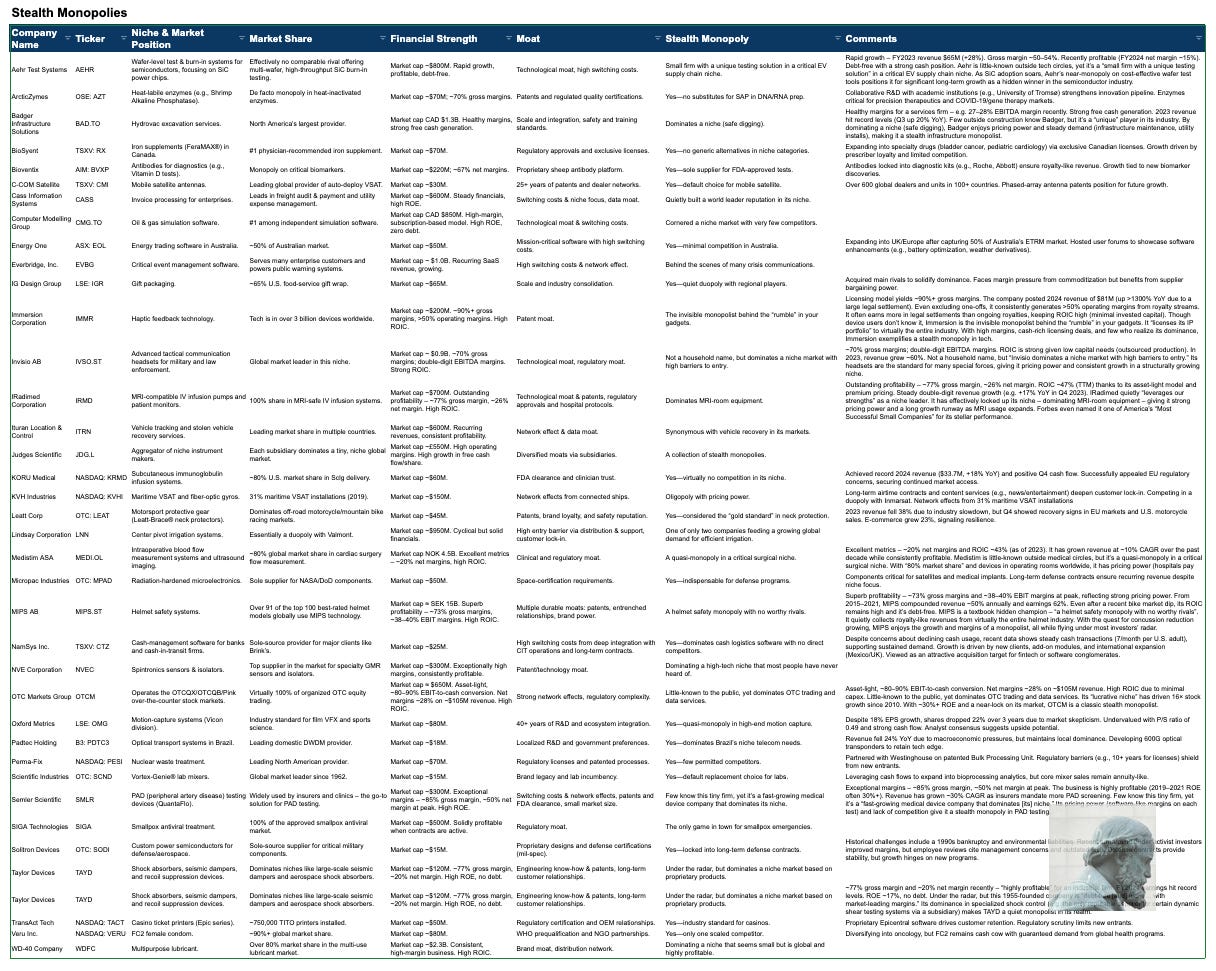

Below there’s a link to a Google Sheets table you can check out. Of course, these ARE NOT INVESTMENT RECOMMENDATIONS. I did not consider their price or valuation, only the fact that they became or are trying to become a stealth monopoly:

https://docs.google.com/spreadsheets/d/1nPjdWkUSD89WPoypbm8z3em1BX-4xf4gdOzOEUtAPrc/edit?usp=sharing

Where to Find Tomorrow's Monopolies: Strategies for Early Discovery

So, how can you find the next stealth monopoly before it gets fairly priced? And what should you be mindful of when investing in one? Here are some key takeaways:

Hunt in Unpopular Forests: Stealth monopolies often lurk in sectors that aren’t “sexy” or trending. You’re more likely to find one in pumps and valves than in popular consumer tech. Let’s keep an open mind to boring businesses – sometimes the company making a tiny widget or providing a niche service has far less competition than the latest hot startup. Read trade journals, industry reports, and even regulatory filings to spot who’s dominating a niche. If a company is repeatedly described as “the leading provider of X” with few peers, put it on your watchlist.

Focus on Moat Metrics Early: When evaluating a potential stealth monopoly, give some weight to the typical financial indicators of moat businesses – high ROIC, high margins, stable cash flows, low customer churn. If you find a small-cap with a 25% ROIC a few years running and double-digit revenue growth, you may have a winner even if the business sounds dull. Likewise, look for evidence of pricing power (are they raising prices annually without losing volume?) and customer captivity (do they lock in multi-year contracts or have recurring revenue north of, say, 80% of sales?). These are flashing signs of a stealth monopoly. In these cases, I think consistency is key – one good year could be luck, but a few of high returns suggests a durable advantage.

Be Early, But Patient: Identifying a stealth monopoly is only half the game; you also need to invest at the right valuation and wait for the thesis to play out. Often, these companies won’t be fully appreciated by the market until some catalyst shines a light on them – may be a few strong earnings reports, inclusion in an index, or a high-profile investor taking a stake. It might take time for widespread attention to arrive. The stock price of a stealth monopolist can experience a slow burn upward, punctuated by big jumps when recognition hits. Stay patient through the quiet periods (as long as the fundamental story remains intact).

Watch Out for Risks: There are always risks. Investing in stealth monopolies isn’t without pitfalls. By definition, these companies have a lot to lose if their moat is breached. Some key risks include:

Regulatory action – a firm dominating a niche could attract regulators if they abuse pricing (think of antitrust or price-cap regulations).

Technological disruption – a new technology could make their niche obsolete (for instance, if a different approach to doing something bypasses the need for that company’s product entirely, think Starlink with VSAT).

Overvaluation – sometimes once the market wakes up to the monopoly, the stock can become overpriced, implying unrealistic future growth.

Sustainability of the niche itself – is it growing, or could it shrink? A monopoly in a declining market isn’t as attractive as one in a secular growth area. There are some exceptions to this, but may be a discussion for another article.

Management strategy – the best stealth monopolies wisely defend their turf and reinvest in their moat. If you see management complacency or reckless expansion outside the niche, be cautious.

Sectors to Watch for the Next Stealth Monopolies: Looking ahead, there are several areas where new stealth monopolies might emerge. Industrial Automation and manufacturing tech may harbor stealthy dominators. For example, a company making a specialized sensor or robotic component might quietly sell to every major automotive factory, with barely any competitors due to high technical barriers. Likewise, enterprise software for niche industries (so-called vertical SaaS) can produce stealth monopolies. Companies like Constellation Software have built empires acquiring these micro-monopolies in software. Infrastructure and B2B services are ripe as well: perhaps a firm that controls a key piece of the EV charging network, or the only provider of a compliance solution for a new regulatory requirement. The key is to look for parts of the economy that are narrow enough to fly under big competitors’ radar, but large enough to matter if one company wins the space.

In all these sectors, keep an eye out for those early signs of dominance. By the time everyone agrees “Company X is the leader in [obscure niche of your choice],” the stock might already have climbed.

Building Wealth with Stealth Monopolies

In this world obsessed with AI and disruptive innovation, I like these companies because they take a different route – they quietly build unassailable fortresses in small markets. They are the ultimate “wide moat” businesses, often delivering years of consistent growth and outsized returns for those perceptive enough to spot them.

The challenge we have is to refine our approach to scouting these hidden giants. That means asking the right questions (Who really dominates this supply chain? Who is the one supplier every competitor in this industry relies on?), and being willing to invest in a business that others might find boring or too niche.

Finding these companies can be a bit like discovering a secret tollbooth on a busy highway – every car that passes pays, and your company is the one collecting. It’s a powerful position for a business to be in. When you do find one of these, be prepared to hold on tight. The ride might start slow, but the destination – robust, compounding returns – is well worth it.

Dorsey, P. (2008). The Little Book That Builds Wealth: The Knockout Formula for Finding Great Investments. Wiley.

I’m personally a fan of Somero - worldwide market leader in concrete screeding, absolutely essential in non-residential construction such as warehouses and data centres, and has consistently made 30% RoE with no debt.

Love it-what a generous gift to give us a spreadsheet with this analysis. Thumbs up