The Power of Simplicity: How to Explain (and Understand) Anything

Strategies and techniques for simplifying complex ideas to make profitable investment decisions

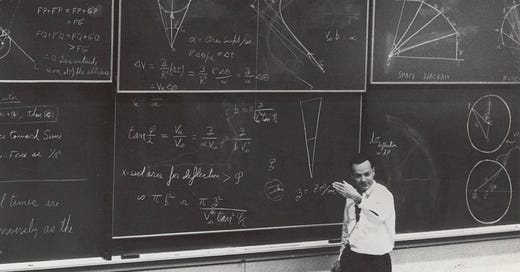

In 1986, the great physicist Richard Feynman was investigating the Space Shuttle Challenger disaster as part of the Rogers Commission.

How could that terrible explosion have happened? NASA had the brightest people; hundreds of engineers had worked on the launch for years. How could it all have come down to that explosion? Buried in complex engineering reports and jargon, the commission, and the public, were struggling to understand the technical reasons for the explosion.

Feynman, known for his ability to simplify complex ideas, cut through the confusion with a simple demonstration. During a televised hearing, he took a small piece of the shuttle's O-ring seal and a glass of ice water. He dropped the O-ring into the water, waited a moment, then pulled it out and bent it, showing how it had become less resilient in the cold.

With this simple experiment, Feynman showed the world how the cold weather on the day of the launch had affected the O-rings' ability to seal properly, leading to the disaster. He took a complex engineering problem and made it understandable to both the commission and the public.

The ability to simplify without losing substance isn't just an academic skill; as investors, simplifying concepts can help us make better decisions, communicate better with colleagues, build trust with clients, and develop a better relationship with management.

So, is it possible to develop the skill of making complex things simple? Are there specific strategies we can focus on? How can this be applied to improve investment skills? Read on.

The Art of Distillation: Foundational Principles

Think about the last time you encountered a complicated concept that seemed almost impossible to understand. What made it so difficult to grasp? Was it the jargon? The abstract nature of the ideas? Or perhaps the volume of information?

These are the hurdles that effective distillation aims to overcome. But how? The short answer is that mastering some key principles can help transform even the most complex financial ideas into clear, simple concepts. The longer answer involves utilizing specific methods tailored to the content you're working with. Don’t worry, we will discuss both.

In reality, the true power of distillation goes beyond individual methods. It's in the synergy between them, the way they work together to create a cohesive, accessible explanation.

The journey to clarity begins with the Principles of Distillation. They are grouped into two phases: 1) Identifying Core Concepts and 2) Prioritizing Information.

Basically, identify what's important, strip it of noise and unnecessary information, then prioritize by sorting by importance and ensuring a logical flow while considering your audience.

Now, you may argue that's common sense for understanding any topic. Nevertheless, as you continue, keep these foundational principles in mind, as they will serve as a good foundation for developing the ability to convey complex concepts with clarity.

“The Wizard of Westwood” And The Use Analogies in Sports And Life

John Wooden, nicknamed "the Wizard of Westwood", was a legendary UCLA basketball coach who led his teams to 10 NCAA national championships in a 12-year period, and was also known for his ability to teach complex basketball strategies and life lessons through simple analogies. One of his most famous analogies involved something as mundane as putting on socks and shoes.

Wooden needed to convey the importance of attention to detail, preparation, and preventing small problems before they become big ones – all important aspects of both basketball and, of course, of life.

On the first day of practice each season, Wooden would gather his players – often the best young basketball talents in the country – and begin with a lesson on how to properly put on their socks and shoes. Here's how he described it:

"Carefully roll the socks down over the toes, ball of the foot, arch and around the heel, then pull the sock up snug so there are no wrinkles or gaps. Smooth out the socks along the sole and around the heel."

He would then demonstrate how to properly lace up and tie their shoes, ensuring a snug fit.

Wooden would explain that this meticulous process wasn't just about socks and shoes:

"Wrinkles, folds, and creases can cause blisters. Blisters interfere with performance during practice and games. Since there's a good way to do it and a bad way to do it, why not take the time to do it right? Besides, your feet are very important."

As you can already see, this simple analogy about socks and shoes ended up being a powerful lesson about:

Attention to detail

The importance of preparation

Preventing small problems before they become big ones

Taking care of the fundamentals

You can assess the impact these teachings had on players, as they often recalled this lesson years later, applying it not just to basketball but to their careers and personal lives.

So why this analogy was so powerful?

It was universally relatable: Everyone has experience with putting on socks and shoes.

It was hands-on: The analogy involved a physical demonstration, making it memorable.

It was unexpected: Coming from a renowned coach to top athletes, the focus on such a basic task was surprising at least.

It was scalable: The lesson could be applied from the smallest tasks to the most complex strategies.

Wooden's socks analogy shows that effective analogies don't need to be complex – often, the simpler and more relatable they are, the more powerful their impact.

If we abstract the process from this story we find that to communicate with powerful analogies we need to:

Identify the core concept: Pinpoint the fundamental idea you're trying to convey.

Find a common experience: Think of an everyday situation or object that shares key characteristics with your financial concept.

Draw clear parallels: Explicitly show how the familiar concept relates to the financial idea.

Refine for accuracy: Ensure your analogy doesn't oversimplify to the point of inaccuracy.

I’d say that here the goal is not just to simplify, but to illuminate. A good analogy should provide an "aha!" moment, where the complex suddenly becomes clear through the lens of the familiar.

Tech Startups And The Elevator Pitch Method

I have to admit, having been around tech startups for most of my career, I never stopped to think about why it's called an "elevator pitch." While researching for this post, though, it turns out it’s because you have to be able to condense the core of your idea or your pitch in the average time it takes to ride an elevator, typically 30 seconds to 2 minutes.

This method isn't just for startups seeking investors; it can also be a great tool for investors looking to distill complex ideas into their essence or while trying to “sell” an investment thesis. I think part of being a successful investor involves "selling" your ideas to other investors so they can "see" what you see in a company. Crafting a good elevator pitch can help to do that.

Since I mentioned startups and the tech industry, some famous pitches comes to mind:

Steve Jobs introducing the iPod (2001): "1,000 songs…right in my pocket."

Chesky’s Airbnb pitch to Y Combinator (2009): "a way to turn your extra space into money and let travelers have authentic local experiences."

Kalanick’s Uber initial pitch: "the best way to get a ride—on-demand car service from a mobile app."

Now, what does an effective elevator pitch means for investor’s trying to communicate an idea? For investors, this often means focusing on some or all of the following:

Potential returns

Risk mitigation strategies

Unique market insights

Competitive advantages

So, how to craft an effective 30-second elevator pitch? In summary:

Identify Your Core Message: What's the one thing you want your audience to remember?

Use Clear, Jargon-Free Language: Like Job’s straightforward description of the iPod’s functionality, avoid complex financial terms.

Focus on Benefits: Explain why your idea matters, not just what it is.

Practice and Refine: Time and iterate until you can deliver your message confidently within 30 seconds.

Jurgen Klopp's "F**king Mentality Giants" And The Power of Storytelling

In 2015, Liverpool Football Club was a struggling team hoping to recapture its former glory. Once a dominant force in English and European football, the club hadn't won a league title since 1990. The departure of star player Luis Suarez to Barcelona had left a void the club was struggling to fill.

So, when Klopp joined by the end of that year, he began weaving a narrative about the team's potential and the power of belief. He came up with the powerful phrase "mentality giants," a term he used to describe players who could overcome any obstacle through sheer force of will and unity.

It was about creating a narrative, about changing the perception the club had about itself. He had to reshape the team's identity and boost their confidence.

You could hear Klopp spoke about the special atmosphere at Anfield and the club's storied past, weaving all this into a narrative that connected past, present, and future. He used the arc of a Hero's Journey to condense that complex history and create a new identity.

And well…apparently the team got the message and went to winning the Champions League in 2019 and the Premier League in 2020, their first league title in 30 years. As I said before, Klopp's storytelling not only explained his football philosophy but also created a powerful shared identity that inspired players and fans alike.

Of course, I don't want to use a monocausal explanation to illustrate the success of one football team, but it does tell you something about the power of narratives.

I like how Aswath Damodaran starts his valuation class asking the students one simple question: "Are you a numbers person or a story person?"

Yes, he wants to challenge the common perception that valuation is all about numbers and financials but he also argues that numbers and stories are complementary in valuation.

Damodaran teaches that the best analysts can weave together the numbers and the story. They can translate a compelling narrative into financial projections, and they can read the story behind a set of financial statements.

At the end of the day, the most effective communicators know that humans are wired to understand and remember stories. Storytelling in investing is the art of weaving data into compelling narratives that engage and persuade the audience.

So, which are different narrative structures you could use? Let’s say for example you want to communicate a new market trend:

The Hero's Journey: Frame market trends as a journey.

Beginning: Establish the initial market condition

Middle: Describe the challenges and obstacles (market forces, economic events)

End: Show how the market overcame (or succumbed to) these challenges

Cause and effect: Link market events in a chain of cause and effect.

Start with a key event or decision

Trace its ripple effects through various sectors or asset classes

Conclude with the current market state and potential future implications

Compare and contrast: Use parallel storytelling to compare different market periods or sectors.

Set up two or more scenarios side by side

Highlight similarities and differences

Draw conclusions about what these comparisons reveal

I think the storytelling approach could be used to write effective case studies while communicating an investment in a company for example. Let’s see how:

Set the scene: Provide context about the company, market conditions, or economic environment. A classic primer or introduction.

Present the challenge: Clearly articulate the problem or opportunity the case study addresses, which is the problem the company solves for its clients.

Detail the strategy: Walk through the steps taken, decisions made, and rationale behind the creation of that solution, how it came to be.

Show the outcome: Present the results, both positive and negative.

Draw lessons: Explicitly state what can be learned from this case and how it applies to the broader theme or trend in the markets.

Encourage analysis: Pose questions that prompt your audience to think critically about the case.

Whether you're explaining a thesis to clients or presenting investment strategies to the general public, effective storytelling can significantly enhance understanding, retention, and engagement.

And, by the way, if you're curious about the title of this section, here's the video.

The “Thing Explainer” and How to Avoid Jargon With “The Feynmann Technique”

In his book "Thing Explainer," Randall Munroe challenges himself to explain complicated subjects using only the 1,000 most common words in the English language. He would famously describe a dishwasher like the "Box That Cleans Food Holders", the periodic table as "The Pieces Everything is Made Of" and the International Space Station as "Shared Space House".

I always thought that if you truly understand something, you should be able to explain it in simple terms. Just like Munroe does.

You can, of course, employ the "ELI5" (Explain Like I'm 5) technique and challenge yourself to explain the concept in the simplest terms possible.

Actually, Feynman was one of the main advocates of this approach. He often spoke about his frustration with the jargon-heavy approach to physics education. He found that many textbooks and lectures relied on complex terminology that obscured the underlying concepts, making it difficult for him to truly grasp the ideas..

His breakthrough came when he started to reimagine these concepts in simple, visual terms. He would create his own explanations using everyday language and mental images. This approach not only helped him understand the concepts more deeply but also enabled him to explain them to others in a clearer, more intuitive way.

So, what are the general rules of the Feynman approach? Below, I share probably the best guidance on how to understand and communicate complex topics from the whole article. So if you're going to remember anything, remember these rules:

Strip Away Jargon

Identify technical terms in the concept you're trying to understand

Replace each term with a simple, everyday word or phrase

Visualize the Concept

Create a mental image or diagram of the concept

Use familiar objects or scenarios in your visualization

Explain to an Imaginary Audience

Pretend you're explaining the concept to a child or a non-expert

Focus on the core ideas, not the technical details

Identify Knowledge Gaps

Note any parts of your explanation that feel vague or uncertain

These are areas where you need to deepen your understanding

Iterate and Refine

Return to the original materials with your simplified understanding

Gradually incorporate more complex elements as your grasp improves

Break Down Complex Systems

Identify the key components or steps in a complex process

Explain each part separately before combining them

Practice Active Recall

Regularly attempt to explain the concept without referring to notes

This helps solidify your understanding and identify weak points

Seek Feedback

Explain your simplified version to others when possible

Use their questions and confusion to further refine your explanation

Feynman's approach to simplifying complex concepts isn't limited to physics and finance. If we aim to be real “Polymath Investors”, this is an must-have tool that can be applied across a wide range of disciplines. The Feynman Technique offers a structured way to break down information, identify knowledge gaps, and build a deeper understanding.

Final Reflections

How to simplify a complex idea? Use analogies.

How to simplify a complex idea? Use an elevator pitch.

How to simplify a complex idea? Tell stories.

How to simplify a complex idea? Avoid jargon.

Mastering the art of simplifying complex financial ideas is not a one-time achievement. It's an ongoing process that requires continuous learning, practice, and adaptation.

I believe that the most successful investors will be those who commit to honing these skills throughout their careers, constantly seeking new ways to make the complex simple and the opaque clear.

As you embark on your own journey to become a better investor, remember the power of simplification. Challenge yourself to explain complex concepts in simple terms, seek inspiration from unexpected sources, and never stop learning.

To bring it home, let me conclude with this video: “The best teacher I never had”."

Further Reading

"Made to Stick: Why Some Ideas Survive and Others Die" by Chip Heath and Dan Heath: This book explores why some ideas thrive while others die, and how to improve the chances of worthy ideas.

"The Craft of Explanation: Making Complex Ideas Accessible" by Lee LeFever: Written by the founder of Common Craft, known for their simple explanatory videos, this book provides a framework for making complex ideas more understandable.

"The Back of the Napkin: Solving Problems and Selling Ideas with Pictures" by Dan Roam: Roam demonstrates how anyone can use simple drawings to clarify complex concepts and communicate ideas more effectively.

"Metaphors We Live By" by George Lakoff and Mark Johnson: This classic work explores how metaphors are central to human thought and communication, providing insights into how to use metaphors effectively to explain complex ideas.

"The Storytelling Animal: How Stories Make Us Human" by Jonathan Gottschall: This book explores the science of storytelling, offering insights into why narrative is such a powerful tool for explaining complex ideas.

Fantastic insights on the importance of simplifying complex concepts! The examples of Richard Feynman and John Wooden beautifully illustrate how powerful simplicity can be in making intricate ideas accessible and memorable.