Unburdened: In Praise Of No Debt

The strategic case for net cash: Ensuring resilience in an unpredictable world

It was April 20, 2010, and the rig exploded in the Gulf of Mexico, killing 11 workers and triggering the worst oil spill in U.S. history. A faulty blowout preventer and misread pressure tests were the internal failures that unleashed 4.9 million barrels of oil to the sea.

A few days had passed from the incident, and in May 2010 an attempt to cap the spill with a containment dome failed when it clogged with gas hydrates. It was a miscalculation of deep-sea conditions that delayed cleanup and prolonged the disaster’s impact.

A few weeks before that offshore disaster, they suffered a toxic release at their Texas City refinery that lasted 40 days. This incident involved a malfunctioning hydrogen compressor in the refinery's ultracracker unit, which led the company to send gases to a flare while continuing operations.

Ok, by now you’d probably guessed which company I’m referring to. The O&G was BP, and the rig explosion, depicted in the image above, was the Deepwater Horizon disaster.

Why I am mentioning all this? Well, you could argue that this company was sloppy or that its operations were mismanaged, but if you look for more examples, you will find dozens of companies hit by unfortunate events. This things happen all the time to all type of companies.

That is why in this article I want to argue in favour of debt-free firms.

Going debt-free could sound almost heretical. Yet I find that some of the most resilient businesses keep doing exactly that – they stay unburdened by leverage.

Why?

Because in business, the way to win the game is to stay in the game. And nothing helps you stay in the game like having zero debt when the world throws a kitchen sink of risks (or tariffs) your way.

Optimal, what?

Every investor knows that finance textbooks insist there’s an optimal level of debt that minimizes a company’s weighted average cost of capital. The theory goes: debt is cheaper than equity, so sprinkle in just enough debt and voilà – you maximize shareholder returns.

“Why hold cash? Let’s borrow at 4% and juice our returns!” According to this doctrine, a debt-free balance sheet is almost inefficient. Corporate finance 101 might even make you feel guilty for not levering up a bit.

But here’s the thing: all these theories assume a frictionless world that doesn’t exist. In the real world, companies face messy, unexpected shocks (we’ll get to those in a moment). That “optimal” leverage calculation conveniently ignores the risk of ruin.

Prudent businesses should minimize debt to maximize capital preservation. And no, this isn’t an original idea—I’m borrowing it from an investor I quote quite often in this newsletter. As Pulak Prasad aptly put it:

“A strong balance sheet is not the one that maximizes debt to minimize the cost of capital, but the one that minimizes debt to maximize the safety of capital.” 1

Sure, debt can work for stable giants with predictable cash flows, but for most of my investable universe (mainly mid and small-caps), I believe the risks outweigh the reward.

In other words, the orthodox focus on squeezing out a slightly lower interest rate pales in comparison to the value of staying solvent and flexible when times get tough. Sure, debt can boost returns in sunny days, but as you know it also amplifies pain in stormy weather.

No debt means no interest payments, no covenants, and no forced timelines – just pure, unencumbered freedom to run the business for the long haul.

So let’s talk about that first big benefit: survival.

Survival: The Way to Win The Game Is to Stay in the Game

“The way to win the game is to stay in the game.” It’s a simple adage, but in business, it carries outsized importance. You can’t build long-term value if you don’t live to fight another day.

The number one job of any company? Don’t go bankrupt. Period. If you can survive every crisis (and there will be many), you get to compound—and eventually, you win.

Leverage is a temptress in good times, boosting your returns – until it turns around and bites hard, threatening your very survival.

Okay, okay—I’m not trying to toss out decades of corporate finance theory. I’m just reasoning from the perspective of long-term investor common sense.

Why is survival such a big deal? Because—let’s face it—the universe has an endless menu of disasters ready to blindside your portfolio company when you least expect it.

Any single catastrophe might be unlikely in a given year, but with enough possible catastrophes, something is bound to occur sooner or later – and often several at once.

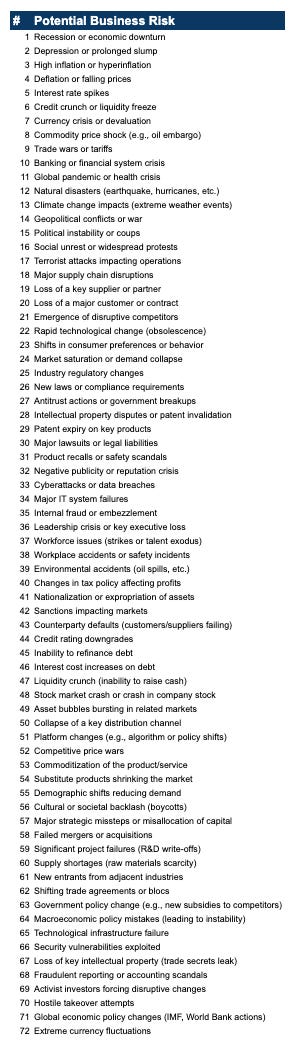

Below is a (non-exhaustive!) list of 72 potential risks that could threaten a business’s health. Each one might be a low-probability event on its own—but the odds that none of them ever happen? Virtually zero. Sooner or later, the unexpected will strike—and if your company is overleveraged when it does, it could be game over.

So, take a deep breath and scan this list:

The point is: while the probability of any single one of these events may be low, the probability that something from this list will hit during your company’s lifetime is extremely high. In fact, multiple crises can compound – a recession (#1) might coincide with a pandemic (#11) and a supply chain meltdown (#18) all at once (hi 2020!).

If you're carrying heavy debt when the storm hits, you might have no margin for error. There’s a reason Buffett used to say “Charlie and I never will operate Berkshire in a manner that depends on the kindness of strangers -- or even that of friends who may be facing liquidity problems of their own.”

This is why survival-oriented CEOs avoid debt. With no leverage, a company facing a crisis only has to worry about operational challenges, not a bank calling in a loan.

No debt means no one can force you into bankruptcy just because you had a bad year. You gain the priceless luxury of time to adjust, cut costs, raise prices, or do whatever it takes to adapt, without the ticking time bomb of interest payments you can’t afford.

Which brings us to the flip side of the coin: a debt-free company not only survives crises – it can thrive during and after them, thanks to strategic optionality.

Strategic Optionality: Fortune Favors the Liquid

With a war chest of cash and no creditors to appease, a company has the optionality to pounce on opportunities that others can’t – especially in tough times.

Cash gives you options: the option to invest in R&D when everyone else is cutting to the bone, the option to acquire a struggling rival at a bargain price, the option to expand into a gap in the market while others retreat.

But most importantly, it gives management the ability to think long-term and take calculated risks without fear of breaching covenants or missing debt payments. Optionality is the freedom to make bold moves for the future precisely when others are paralyzed by short-term concerns.

When you’re unburdened by fixed obligations, you have the agility to adapt strategy on the fly. You answer to your customers and your vision, not to the bank.

It’s hard to play to win when you’re playing not to lose. Or like Bill Belichik used to say: “You can’t win until you keep from losing.”

Unburdened For The Long Game

In praising of no debt, I’ve tried to highlight two massive advantages: survival and strategic freedom. Companies that stay unlevered can weather the unimaginable and emerge stronger—while others risk everything for a marginal edge when times are good.

Running with no debt substantially increases the odds of long-term survival. Remember, you can’t compound returns if you get wiped out.

Does all this mean I’ll only invest in companies with no debt? Maybe not. But a net-cash balance definitely ranks very high on my list of desirable traits.

Pulak Prasad’s wisdom bears repeating: a truly strong balance sheet is one that minimizes debt to maximize the safety of capital.

If you liked this article, please give it a like o subscribe below if you haven’t done so!

Prasad, P. (2023). What I learned about investing from Darwin. Columbia Business School Publishing.

Number 38 is the one where people die.

The best companies are anal retentive, floors are too clean, too much attention is devoted to reliability and maintenance.

When equipment is purchased and the purchasing department is more involved than the reliability engineers, be warned.

The only exception that comes to mind is when a company is unprofitable but also needs a war chest of cash to weather tough times.

In Feb 2000 (right before the dotcom crash), Amazon raised almost $700m in convertible debt from European investors, which ended up saving the company and allowing it to become the 4th most valuable company in the world today. https://www.vox.com/new-money/2017/4/5/15190650/amazon-jeff-bezos-richest